Your Guide to the Melbourne Property Market: 7 Simple Facts

The Australian property market can feel a bit confusing. You hear so many different stories! But for people like you in Melbourne, Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, and Werribee, understanding the market is key. It helps you make smart choices, whether you’re buying your first home or adding to your investments.

Dr. Shane Oliver, a top economist, shared seven important charts. They help us see what’s really happening. Let’s look at them together.

“Australia’s housing market is turning up again. Lower interest rates are a big reason. There’s also a shortage of homes, between 200,000 and 300,000. Building homes takes longer now. Prices are high in some places, but this changes between cities. Also, very few people are falling behind on their mortgages. We expect prices to go up 5-6% this year because of lower rates, but high prices will slow it down a bit.”

1. Property Prices Are Going Up (Again!)

After a short break, Australian property prices are now rising. This is good news! CoreLogic data shows home values are increasing across the country. Even cities like Melbourne, which were a bit slower before, are seeing prices go up. This shows the market is strong. For you in Melbourne’s west, this means the market is getting more active.

Source: AMP

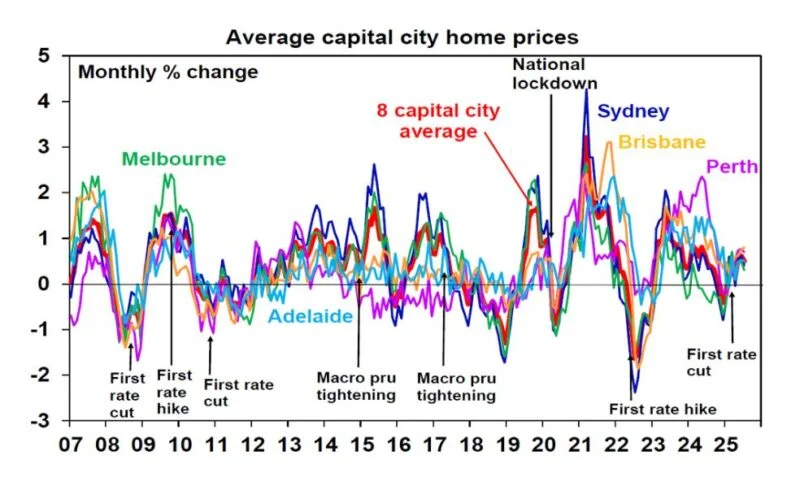

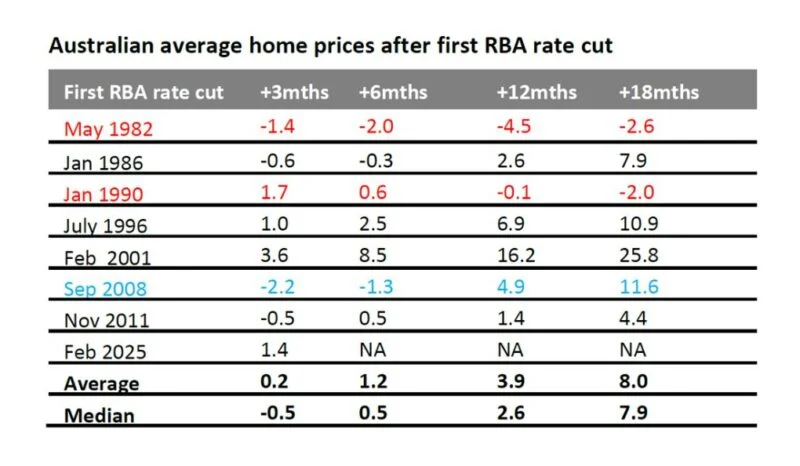

2. Interest Rates Drive Prices

It’s simple: when interest rates go down, it’s cheaper to borrow money. This makes buying property more attractive. Prices started to go up when rates began to fall earlier this year. AMP thinks the Reserve Bank will cut rates again soon, maybe in August. Lower rates mean more buying power for you, especially in areas like Tarneit, Hoppers Crossing, or Point Cook.

Source: AMP

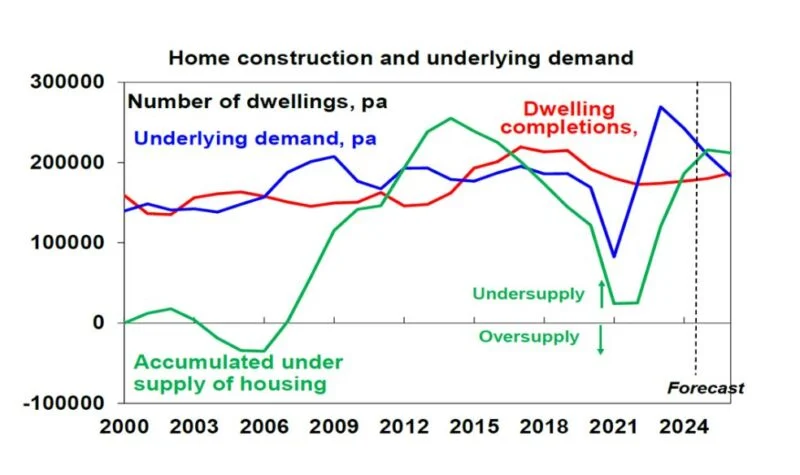

3. Not Enough Homes: A Big Problem

Australia has a big housing shortage. We need about 200,000 to 300,000 more homes. Our population has grown quickly, but we haven’t built enough houses. This lack of homes is a main reason why prices keep going up over time. In places like Wyndham and Melton, fewer homes mean prices stay high.

Source: AMP

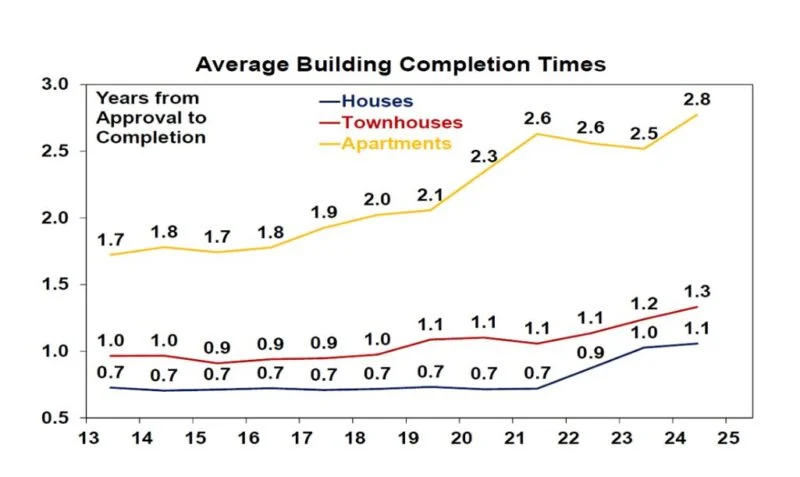

4. Building Homes Takes Longer

To fix the housing shortage, we need to build homes faster. But it’s taking much longer now. House construction times have gone up by 57% in ten years. Unit builds take 65% longer. Why? It’s a mix of complex rules, high building costs, and not enough workers. Governments need to build 1.2 million new homes in five years. This is part of the National Housing Accord. Longer building times can affect new housing projects in areas like Rockbank or Werribee.

Source: AMP

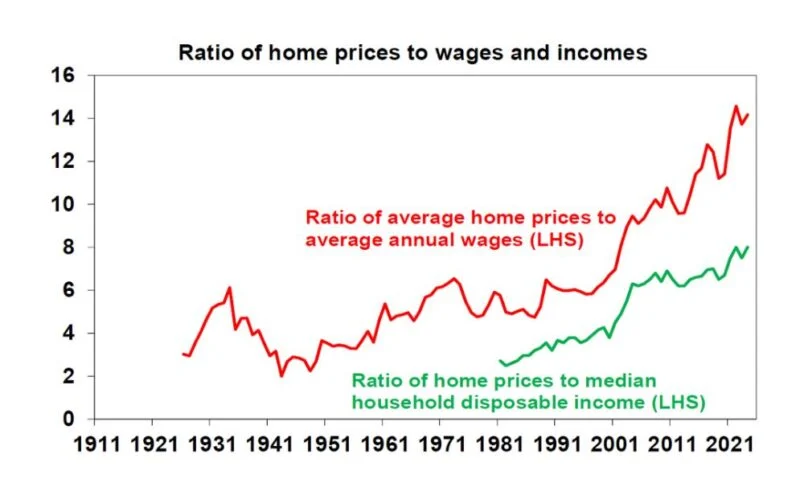

5. Yes, Property Is Costly (But There’s More to Know)

Buying property in Australia is expensive. It takes almost 10 years to save a 20% deposit now. In the 1980s, it took only 4 years. House prices are high compared to wages. This doesn’t mean prices will crash. But it might limit how much prices can go up. High prices and debt can be a risk if more people lose their jobs. For smart investors, this means being careful. Pick good properties and think long-term. Melbourne units, for example, often offer better value.

Source: AMP

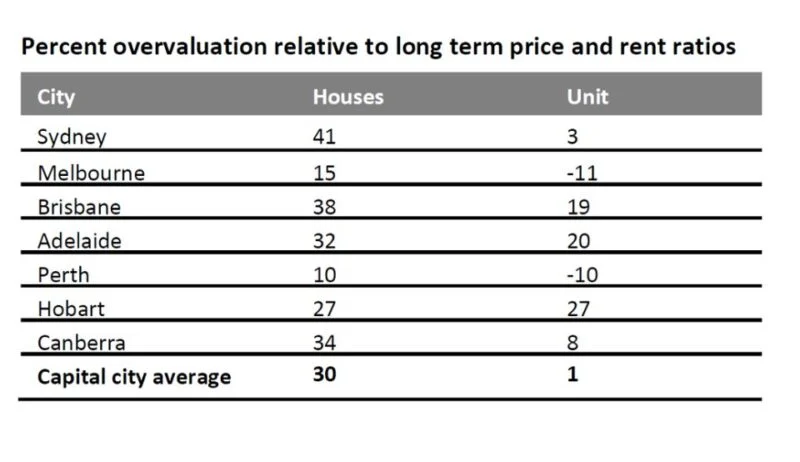

6. Many Local Markets, Not Just One

We often talk about “the Australian property market.” But it’s really many small markets. They all move at different speeds. Dr. Oliver’s data shows this clearly. Houses are quite expensive. But units are only a little bit expensive. Perth and Melbourne houses seem to be better value. Units in both cities might even be a good deal. This means you can find good opportunities by looking at specific cities and property types. For those in Melbourne’s western suburbs, looking at units in areas like Tarneit or Werribee could be a smart move.

Source: AMP

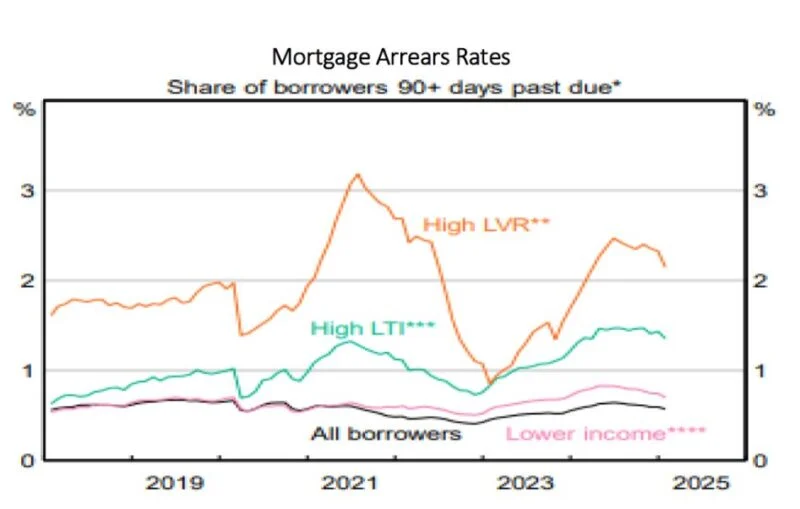

7. Mortgage Arrears Are Still Low

Even with talk of mortgage stress, very few people are falling behind on their home loan payments. It’s less than 1%. This is because lending rules are strict. Also, many people still have jobs, and some saved money during COVID. A big rise in unemployment would be needed to push prices down. This low arrears rate helps keep the market stable for homeowners and buyers in Melbourne.

Source: AMP

What’s Next for the Market?

Dr. Oliver thinks national property prices will go up by 5-6% this year. This is due to lower interest rates and not enough homes. But high prices will limit this growth.

There are a few risks: prices could go down if many people lose jobs. Or, if interest rate cuts make many people want to buy, prices could go up even more.

For investors, this market needs a plan. Buy properties in good locations. Look for strong rental returns. Don’t listen to extreme predictions. The market isn’t cheap. But for smart buyers, there are still chances to grow your wealth.

Need Help with Your Property Journey? Talk to Ez Mortgage Broker!

Are you thinking about your next property move? Should you buy, sell, or wait? Expert advice can make a big difference.

At Ez Mortgage Broker, we give you clear advice and help you get results. We understand the market in Melbourne, especially in areas like Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, and Werribee. We help you reach your money goals.

We help our clients by:

- Strategic Property Advice: We can create a personal property plan for you.

- Home & Investment Loans: As your local mortgage experts, we work with many lenders. We help you find the best loan for your first home, next home, or investment property.

- Refinancing Solutions: Want to save money? We can check your current home loan.

- Construction Loans: Building your dream home? We guide you through the finance process.

- Financial Health Checks: We make sure your mortgage is working for you.

Don’t let the market confuse you. Partner with Ez Mortgage Broker for smart advice.

Contact Ez Mortgage Broker today for a free chat!

Phone: 1300 050 099 Email: [email protected]