Easy Guide: Melbourne Home Loan Rates Today (July 2025)

Buying a home or refinancing your loan can feel like a big step. But understanding home loan rates doesn’t have to be hard. This guide makes it simple! If you live in Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, Werribee, or anywhere in Melbourne, knowing about today’s rates helps you make smart choices.

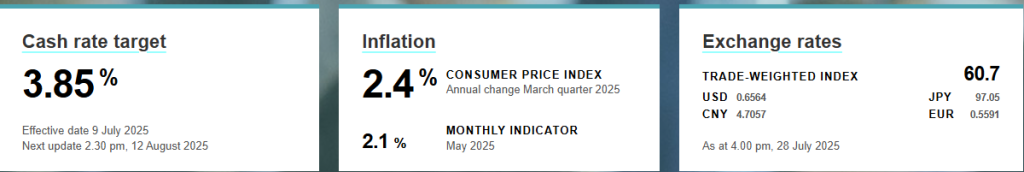

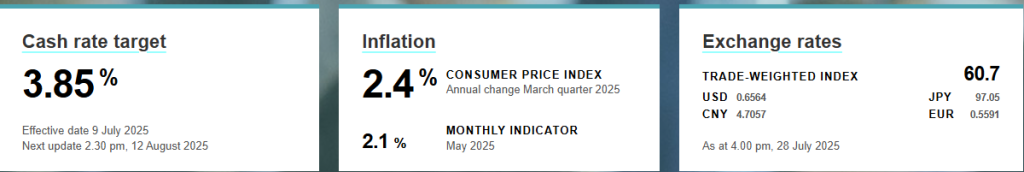

Current rates are seeing small shifts, but experts expect further cuts by late 2025, potentially making home loans more affordable.

As of July 2025, home loan rates are moving a little. Changes are generally small. Let’s look at what mortgage and refinance rates mean for you right now.

What are Today’s Home Loan Rates in Melbourne?

In Australia, home loan rates change often. They depend on your lender and your own money situation. Here are some example rates you might see for common loan types in July 2025:

- Fixed Rates (e.g., 1 to 3 years): You might find fixed rates from about 4.74% to 5.29% per year. These rates stay the same for a set time. This gives you peace of mind with your payments.

- Variable Rates: These rates can start around 4.99% per year. Variable rates can go up or down. This offers more freedom with your loan.

Important: These are just examples. Your exact rate depends on things like your deposit size, your credit score, and the bank you pick. For your personal best rate, always talk to a home loan expert!

Want to know how to get a lower rate? Read on!

What are Refinance Rates Today?

Thinking about getting a new home loan for your current property? This is called refinancing. Refinance rates are also part of the market. In Australia, these rates can be like new home loan rates.

You might find refinance rates similar to the examples above.

Why Refinance? Even a small drop in your interest rate can save you lots of money over time! Refinancing could help you:

- Get a lower interest rate.

- Make your monthly payments smaller.

- Combine your debts into one easy payment.

- Use your home’s value for updates or new investments.

[Image: A graphic of a piggy bank with coins flowing in, labelled “Save Money with Refinancing.” Alt text: “Refinance Rates Melbourne – Save Money on Your Home Loan”]

See Your Monthly Home Loan Payment

It’s helpful to know what your monthly home loan payment might be. This helps you plan your budget. Our free home loan calculator can help! It looks at your loan amount, interest rate, and how long you’re taking to pay it back. It also considers things like property taxes and home insurance. This gives you a more realistic idea of your total monthly cost.

Try our free home loan calculator now! [Link to your website’s mortgage calculator]

30-Year vs. 15-Year Home Loans: Which is Best?

In Australia, most home loans are for 25 or 30 years. You can also find 15-year options. A 30-year loan is popular. It spreads out your payments. This makes each month’s payment lower.

- 30-Year Home Loan: This means smaller payments each month. It makes buying a home more affordable. You have more cash for other things. But, you’ll pay more interest over the long run.

- 15-Year Home Loan: This usually has a lower interest rate. You pay off your loan much faster! This saves you a lot of money on total interest. But, your monthly payments will be higher. This is because you pay the same amount in less time.

Let’s use an example with $500,000 borrowed:

- If you get a 30-year loan at an example rate of 5.50%: Your monthly payment might be around $2,839.

- If you get a 15-year loan at an example rate of 5.00%: Your monthly payment might jump to around $3,954. But you save a lot on interest over time.

Your choice depends on your money goals. Do you want lower monthly payments or to save lots on interest over time?

Fixed-Rate vs. Variable-Rate Home Loans

When you choose a home loan, you pick between a fixed or a variable rate.

- Fixed-Rate Home Loan: Your interest rate stays the same for a set time (like 1, 2, or 3 years).

- Good points: Payments are steady, budgeting is easy, and you’re safe if rates go up.

- Things to know: You won’t save if rates drop. Breaking the fixed term early can mean fees.

- Variable-Rate Home Loan: Your interest rate can change at any time. It usually moves with the Reserve Bank of Australia’s (RBA) cash rate.

- Good points: You save money if rates go down. Often has flexible features like offset accounts. You can make extra payments without fees.

- Things to know: Payments can go up if rates rise. This makes budgeting less certain.

Many people choose a split loan. This means part of their loan is fixed, and part is variable. It gives you some certainty and some freedom!

Tips to Get a Lower Mortgage Rate

Lenders usually offer the best home loan rates to people with:

- A bigger deposit: Try to put down at least 20% of the home’s value.

- Great credit history: Always pay your bills on time. This builds a strong credit score.

- Low debt compared to your income: This means your monthly debt payments are small compared to how much you earn.

Instead of just waiting for rates to fall, focus on making your own money situation stronger. This is often the best way to get a better rate now.

Choosing the Best Home Loan Lender

Finding the right lender for your home loan is a big step. Here’s some helpful advice:

- Apply for pre-approval with a few lenders. Do this within a short time (like 2 weeks). This gives you the best comparisons. It also has less impact on your credit score.

- Look at the Annual Percentage Rate (APR). This is the most important number! The APR includes the interest rate, plus any fees. It shows the real yearly cost of borrowing money. A lower APR means you pay less overall.

Ez Mortgage Broker works with many different lenders across Australia. We can compare many options for you. We help you find the most competitive rates and the right loan for your needs.

Your Local Home Loan Experts in Melbourne’s West

Whether you are in Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, or Werribee, understanding these details helps you with your home journey. You don’t have to do it alone!

The friendly team at Ez Mortgage Broker is here to help you. We give clear advice and guide you to the best home loan or refinance option. We make the whole process easy and stress-free.

Contact Ez Mortgage Broker today for a free chat!

Phone: 1300 050 099 Email: [email protected]