RBA Rate Cut Hopes for Tarneit Homeowners Hang on Inflation Data

Homeowners are eager for lower interest rates. Many in Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, Werribee, and wider Melbourne want relief. But the Reserve Bank of Australia (RBA) is being careful. They are waiting for key inflation data. This data will be released on Wednesday. It will help decide if millions of Australians with mortgages get a rate cut next month.

The RBA board surprised many earlier this month. They decided to keep the cash rate at 3.85%. Most experts thought they would lower it.

Now, with the next meeting on August 11-12, many still expect a rate cut. But there’s a big “if.”

“Unless this [week’s inflation report] is a surprise … then almost certainly we will get a rate cut,” says Jonathan Kearns. He is chief economist at Challenger and a former RBA official.

Adam Boyton from ANZ agrees. A high consumer price number could “derail an August rate cut.”

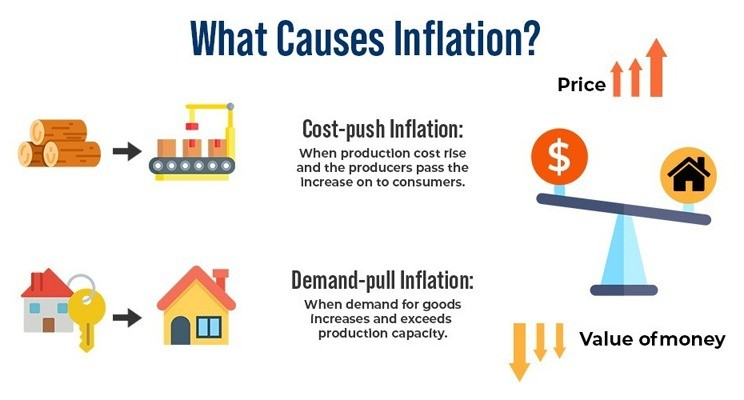

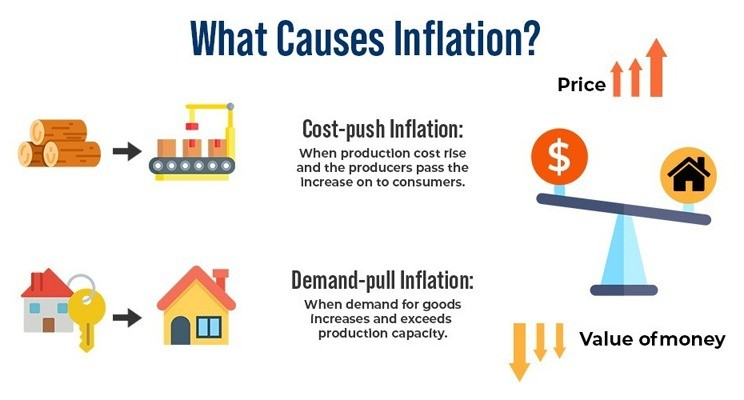

Why the Delay if Inflation is Dropping?

Inflation has been falling. It peaked at 7.8% at the end of 2022. It dropped to 2.4% in June. Economists expect it to ease further to 2.2% in the year to June. The RBA’s target range for inflation is 2% to 3%.

So, why are they still holding back?

Michele Bullock, the RBA governor, says rates are “on the way down.” But she also says the RBA “will not be rushed.”

At the last meeting, most board members wanted more information. They want to be sure inflation will stay at 2.5% in a steady way. Monthly price figures, which show only part of the picture, made them worry. Inflation might not be dropping as fast as they hoped.

Other concerns include possible trade issues with Donald Trump. Also, billions in government subsidies have helped lower bills.

For example, household electricity bills would be 26% higher without government rebates. As these payments end, inflation might rise again. The RBA’s May forecasts suggest inflation could drift back towards 3% by the end of the year. It could take 18 months to get back to 2.6%.

The RBA looks at an “underlying” inflation measure. This removes big price swings like for electricity and petrol. This gives a clearer picture. Using this “trimmed mean” measure, inflation just returned to the target range. It was 2.9% in the year to March.

This core inflation rate is what economists will focus on. The report comes out Wednesday at 11:30 am.

Jonathan Kearns says a “surprise” would be prices rising much faster than expected. They expect a 0.7% rise in the underlying figure for the three months to June. A rise of 0.9% or more would make the RBA “pause for thought.” This would push the annual rate to 3%.

Adam Boyton expects the quarterly underlying inflation figure to be 0.6%. That’s 2.7% year-on-year. But even a 0.8% quarterly increase would “present a challenge for the board.”

What This Means for Your Home Loan

The upcoming inflation data is very important for homeowners in Tarneit and surrounding areas. A lower inflation number could mean an RBA rate cut in August. This would bring welcome relief to your mortgage repayments.

However, if inflation is higher than expected, the RBA may wait longer. This means continued pressure for many.

At EZ MORTGAGE BROKER, we understand these concerns. We keep a close eye on RBA decisions and market trends. We can help you understand what current and future rates might mean for your specific home loan. Whether you are worried about your current repayments or planning a future purchase, we offer expert advice.

Don’t let market uncertainty cause you stress. Contact EZ MORTGAGE BROKER today for a free chat about your home loan options.

Phone: 1300 050 099 Email: [email protected]