New Home Loans Up, Refinancing Soars in FY25: What It Means for You in Melbourne

Good news for the Australian mortgage market! A new report from PEXA shows strong growth in new home loans and a big jump in refinancing during the last financial year (FY25). This is great news for homeowners and buyers in Melbourne, Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, and Werribee.

Why the boost? PEXA says it’s due to lower interest rates, homes becoming more affordable, and more help for first home buyers (FHBs).

More Loans, More Buyers

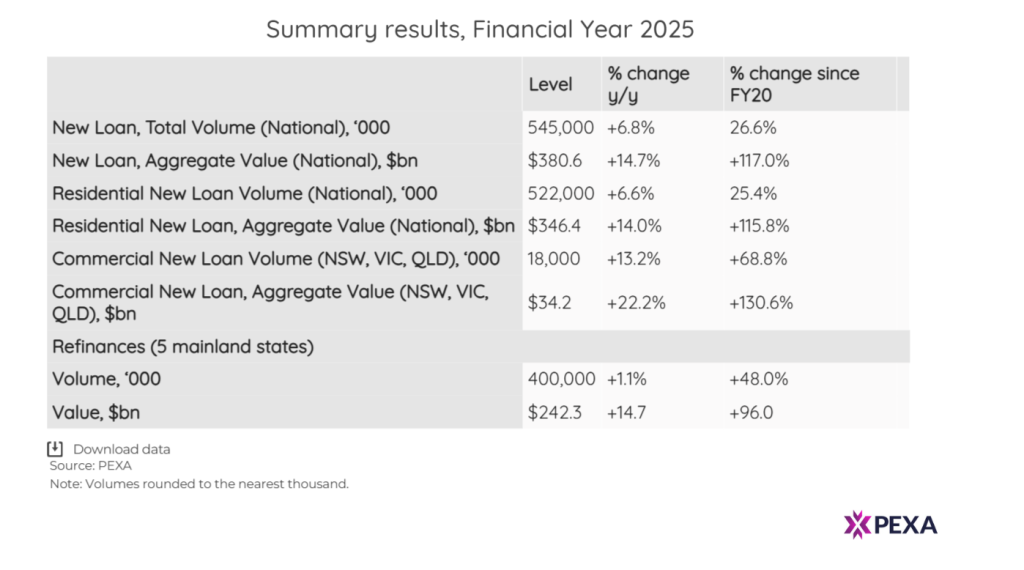

A lot of new property loans settled in FY25. The total was 544,630 loans. That’s up 6.8% from the year before! Most of these (96%) were for homes. This growth far outpaced the overall growth in property deals. This means more people needed loans to buy homes. Many buyers are relying more on loans. This is due to tighter budgets and better FHB help.

Victoria Leads in New Home Loans

While Queensland had the most property deals overall, Victoria led in new home mortgages! We saw 148,126 loans settled here. Queensland was close with 146,157. New South Wales had 142,653. Both Victoria and Western Australia had the highest share of deals linked to loans, at 77.2%.

The total value of new loans also jumped. It hit $380.6 billion for the financial year. Residential loans made up $346.4 billion of that. This is a 14% increase from last year. These trends happened as Australian property prices kept going up. This was driven by limited homes for sale, strong buyer interest, and hopes for more rate cuts later in 2025.

Lower Rates and Good Jobs Helped

The Reserve Bank of Australia (RBA) cut its cash rate twice. Once in February and again in May. This made households feel better about spending. It also helped loan settlements grow.

Job growth was good at 2.1% annually. Wages grew faster than inflation (3.4% versus 2.4% in March). This meant people had more real income. This boosted their ability to borrow. Stable jobs and income also helped keep mortgage payments on track. They also supported new property price growth.

Refinancing is Popular After Rate Cuts

Many homeowners switched loans in the second half of FY25. They wanted better deals after interest rates dropped. Refinance settlements grew by 1.1% over the year. They reached 401,114 across Australia.

In the June 2025 quarter alone, refinances surged! They jumped 20.3% from the previous quarter. They were up 20.1% compared to last year. Refinancing was especially strong in Western Australia, Queensland, and South Australia. Victoria saw a slight drop (7.7%) as activity returned to normal after earlier high points. The total value of refinanced loans reached a new high in the June quarter.

Commercial Loans Grew Faster

Commercial property loans grew faster than home loans in FY25. They were up 13.1% versus 6.6%. Even though demand for office space is lower after COVID, the rise in commercial lending shows good business confidence. It also shows businesses are diversifying their investments.

Loan Sizes Show Pressure and Shifts

New South Wales still has the highest prices. The average loan in Greater Sydney was $800,000. This is up 5.2% from last year. But interestingly, regional NSW buyers are now borrowing more than those in Greater Melbourne. This highlights challenges with affordability.

Victoria’s home prices have been fairly flat. Plus, there’s more supply of homes here. This helped keep loan growth modest. The average loan value grew 4.7% in Greater Melbourne and 6.7% in regional Victoria.

Queensland saw the biggest increases. Greater Brisbane’s average loan rose 12.6% to $640,000. Regional Queensland’s average loan was up 15.1% to over $525,000.

Government Help Boosts First Home Buyers

Special programs and discounts for first home buyers are a big reason for more loan-backed purchases. These programs played a key role in states with more loans for homes, especially in Victoria and Western Australia, PEXA reported.

You can read the full PEXA report for more details.

How EZ MORTGAGE BROKER Can Help You

These trends show a changing mortgage market. It’s vital to have the right advice. At EZ MORTGAGE BROKER, we stay on top of these changes. We understand what this means for you in Melbourne and our local areas.

Whether you are:

- Buying your first home 🏡

- Looking for a new loan 🆕

- Wanting to refinance for a better deal 🔄

We can help! We provide clear, easy-to-understand advice. Our goal is to find the best mortgage solutions for your needs.

Don’t miss out on potential savings or opportunities. Contact EZ MORTGAGE BROKER today for a free chat about your home loan options!

Phone: 1300 050 099 Email: [email protected]