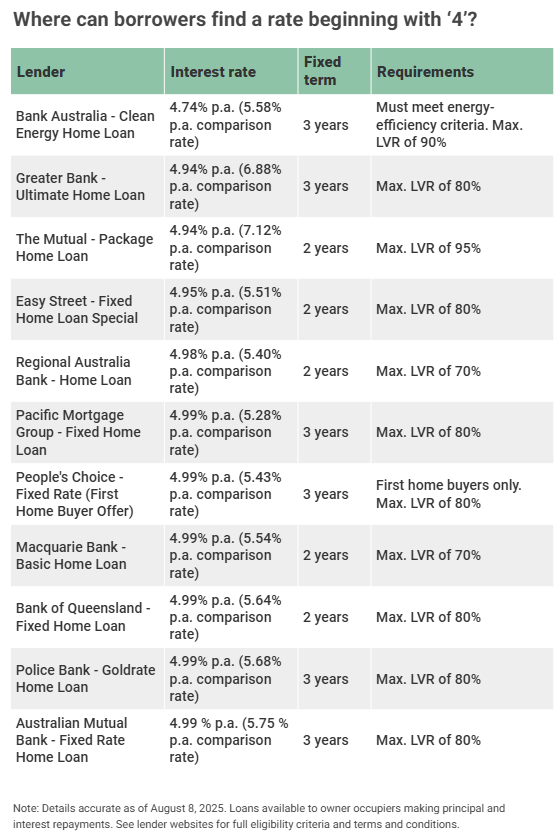

Find a Mortgage Rate Starting with 4

Are you looking for a great home loan? Good news! Lenders are competing more than ever. Some are now offering rates that start with a ‘4’. This is great for people buying a home or those who want to refinance.

Why are rates getting lower?

Lenders are getting ready for possible rate cuts. The Reserve Bank of Australia (RBA) may cut rates soon. Lenders want to attract new customers. Because of this, some are lowering their rates. This is especially true for fixed-rate loans.

A Low Fixed Rate

A low fixed rate may seem good. But you should think about it first. What if the RBA keeps cutting rates? You could miss out on even lower rates later. It is smart to look at all your options.

A mortgage broker can help you decide. We can help you pick a fixed, variable, or split-rate loan that is best for you.

Small Changes, Big Savings

Even a small change in your interest rate can save you money. For example, a difference of just 0.50% can save you over $2,500 a year on a typical loan. This is why it is so important to check your rate. You must be sure it is a good one.

Ready to Find a Better Rate?

If you are looking for a mortgage rate starting with 4, we can help. Our experts can help you compare options. We will make sure you are getting a great deal.

Contact EZ MORTGAGE BROKER today for a free chat.

- Phone: 1300 050 099 or 044789007

- Email: [email protected]

Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).