ANZ vs BoQ: The Mortgage Market Is a “Rollercoaster”

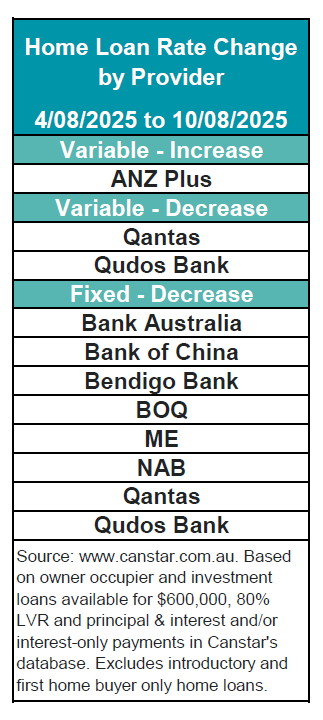

The Australian home loan market is a wild ride right now. In just one week, we saw some lenders hike rates while others dropped them to a new low. This shows how hard it can be for you to keep up with all the changes.

ANZ increased some of its rates. But at the same time, Bank of Queensland (BoQ) posted a new low fixed rate of 4.89%. This is a great deal for some people!

How Does a Mortgage Broker Help?

With so many changes, how do you find the best rate? This is where an expert mortgage broker Australia is so important. We do the hard work for you. We look at rates from many different lenders. This is much easier than you trying to compare them all yourself.

We can help you find a great deal. This is true even with big banks making strange rate changes.

More Competition, More Savings

Lenders are getting ready for a possible RBA rate cut. This means there is more competition to win your business. This is great news for you! It means better deals are out there.

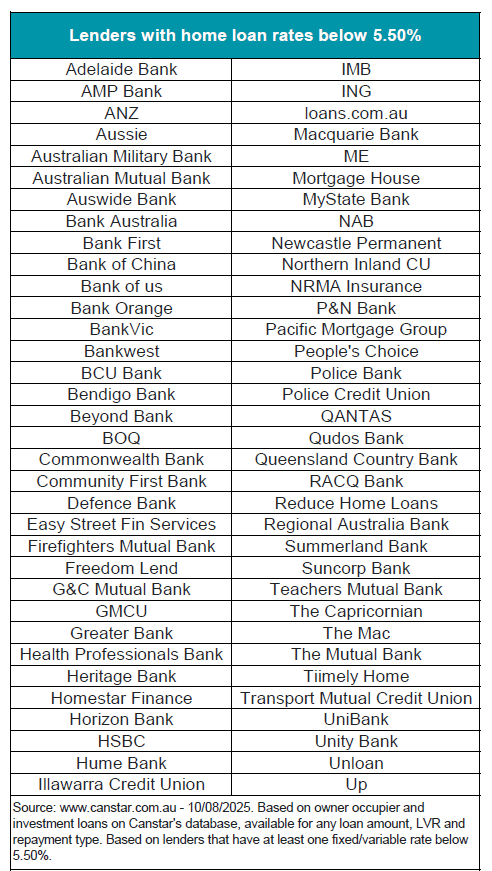

Did you know there are over 900 rates below 5.5% right now? That is a lot of options! We can help you find the one that fits your needs. To learn more about how we help, check out our guide on refinancing your home loan.

Let Us Do the Work

Don’t get lost in the “rollercoaster” of rate changes. An EZ Mortgage Broker can help you find a great rate and save you money. Let us do the hard work for you. We will compare loans and get you the best deal.

Contact EZ MORTGAGE BROKER today for a free chat.

- Phone: 1300 050 099 or 044789007

- Email: [email protected]

Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).