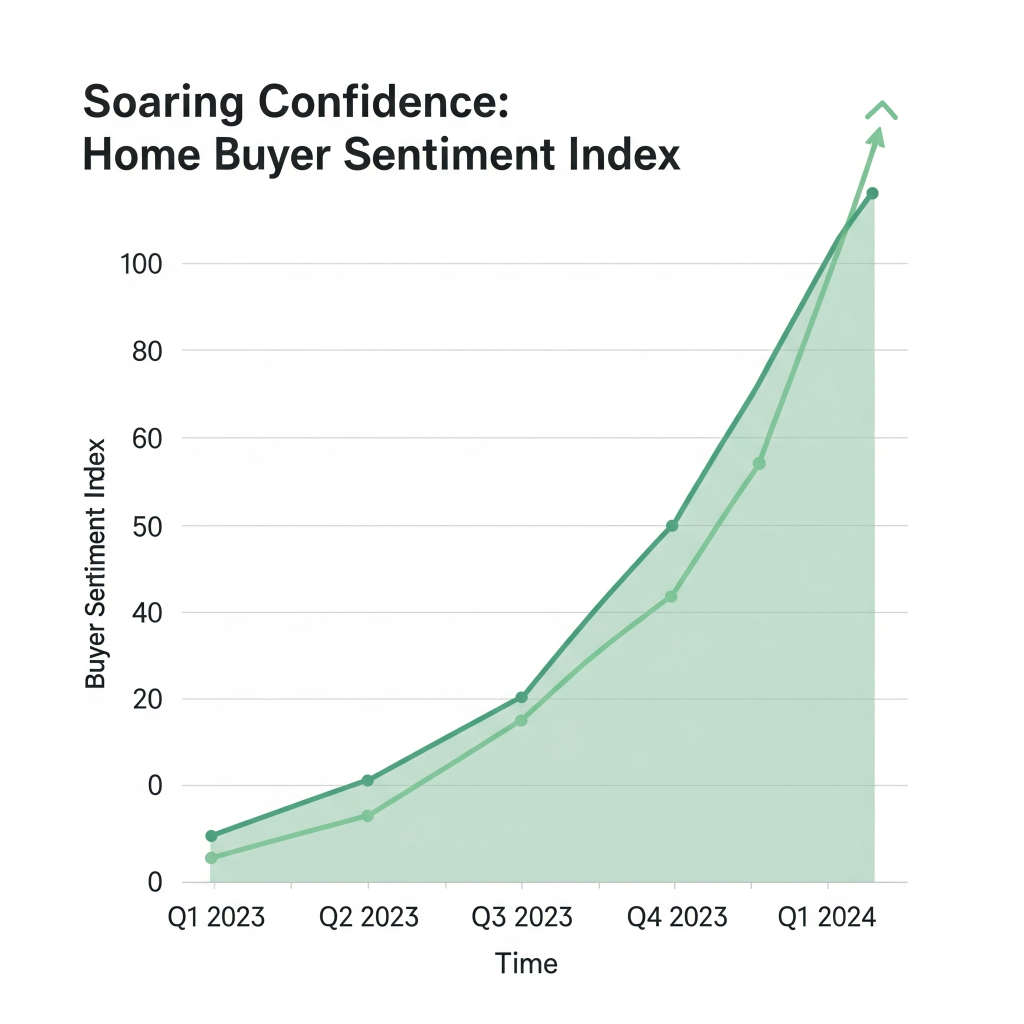

Home Buyer Sentiment is the Highest in 4 Years!

Good news! People in Australia feel better about buying homes. A new report shows that home buyer sentiment is the highest it has been in over four years. This is a very good sign. It shows that people are feeling more confident about the housing market.

This good feeling comes from the RBA. The RBA has cut rates three times this year. This has made home buyers and people with a mortgage feel much better.

What the Numbers Say

The study shows that people are very hopeful. The number for “good time to buy a home” went up a lot. It is now 37% higher than last year.

People also think house prices will go up. Three out of four people think prices will rise over the next year.

This good feeling is not just for home buyers. It is also for people who have a mortgage. They have seen a big improvement in their confidence. This is likely because of the lower interest rates.

What This Means for You

This good news means the market is getting stronger. When people feel more confident, it can be a good time to buy. It is also a great time to make sure your current home loan is the best one for you.

We can help you with this. We know the market well. We can help you find a great home loan. We can also help you with a home loan health check to see if you can save money.

The new RBA rate cut has helped many people save money. We can show you how to get the most out of it.

Contact EZ Mortgage Broker today for a free chat. We can help you turn your confidence into action.

- Phone: 1300 050 099 or 044789007

- Email: [email protected]

Important Information:

Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).