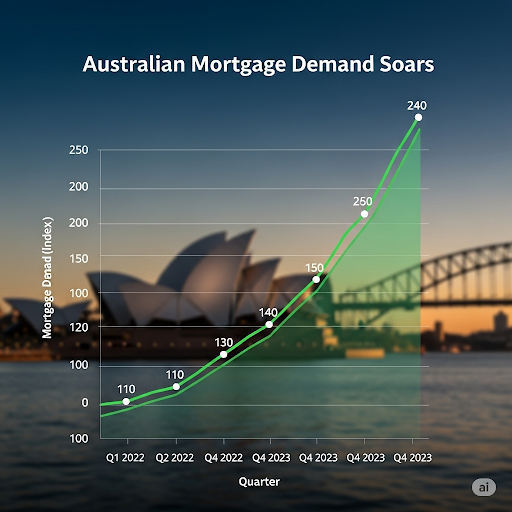

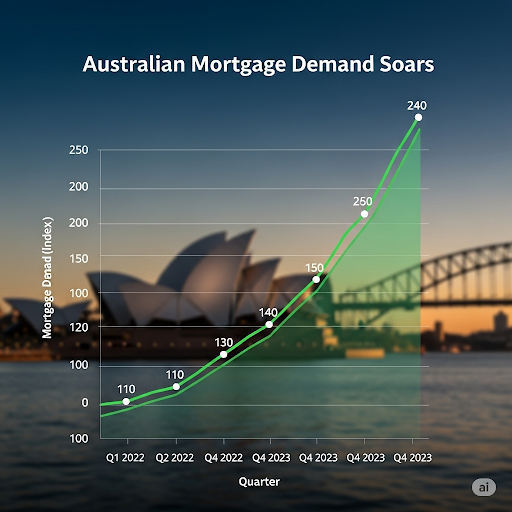

Mortgage Demand Australia is Booming 🚀

People want home loans. New numbers show that mortgage demand in Australia is very high. It is growing fast. The main reason is refinancing. Homeowners are switching loans. They want a better deal. This is why credit demand is going up.

Why Is Demand So High?

Interest rates are falling. The RBA has cut rates. This makes people feel good.

They think rates will keep falling. So they are looking for new deals. Many homeowners are getting a better rate now.

Refinancing is a Big Trend

Refinancing is very popular. More than a third of all loan requests are for refinancing. Homeowners want to save money.

They are using lower rates to get a better loan. You can learn more about how an RBA rate cut helps with this.

New home loans are also being created. This shows people are still buying. But it is harder for first home buyers. It is tough to buy a home in a big city.

What This Means For You

The market is active. People are saving money. You can too. A mortgage broker can help.

We can look at many loans. We will find a great rate for you. We can help you refinance. We can help you buy a new home. We can also help with a home loan health check to see how much you could save.

Don’t miss out on savings. Contact us today. We can help you get a great deal.

- Phone: 1300 050 099 or 044789007

- Email: [email protected]

Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).