Australian Mortgage Savings: Rate Cuts Are Here! 💰

Millions of people will save money on their home loans. The big banks are passing on the latest rate cut from the RBA. This means more Australian mortgage savings for you.

Who Is Saving?

Commonwealth Bank (CBA) and ANZ are already passing on the savings. Their variable rates are now lower. This started last Friday. NAB and Westpac will also cut their rates soon.

CBA is also cutting rates for fixed-term loans. You can save up to 0.45%. This depends on your loan type. For example, a two-year interest-only loan is now 5.69%.

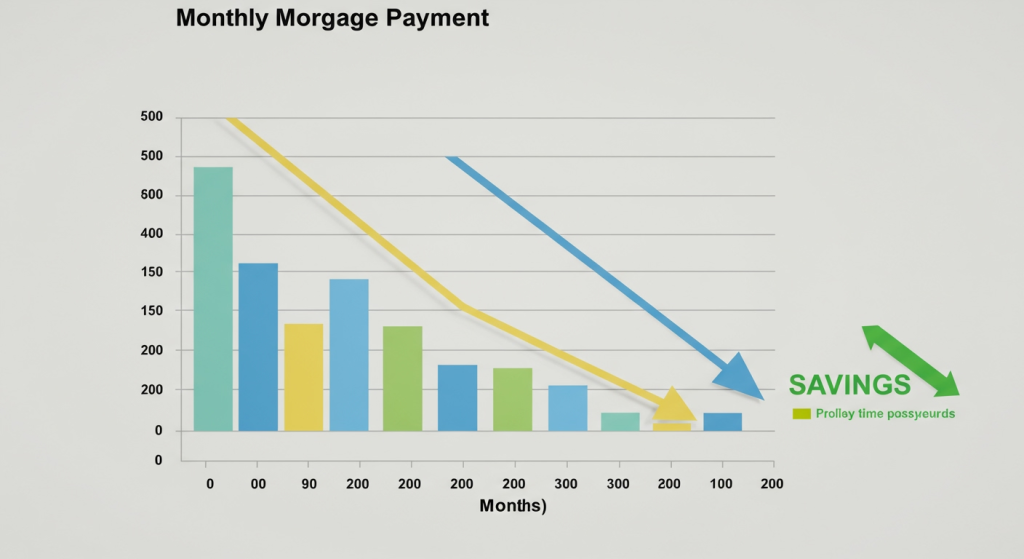

How Much Can You Save?

These rate cuts can add up to a lot.

- On a $500,000 loan, you could save about $74 per month.

- On a $1 million loan, you could save about $148 per month.

Adding this to the first two rate cuts this year, the total savings are big. A $500,000 loan could save you about $226 per month. A $1 million loan could save you about $453 per month.

Get the Best Deal

Some lenders move faster than others. For example, Athena and Unloan cut their rates minutes after the RBA news. Other lenders take a few weeks. Some are not passing on the full cut at all.

You can read more about this in our article: RBA Rate Cut: Which Lenders Moved First?

A mortgage broker is here to help you. We can compare many different lenders. We will find the best rate for your situation. It’s the best way to make sure you get the full Australian mortgage savings you deserve.

Contact EZ Mortgage Broker today. We will help you find a great deal!

- Phone: 1300 050 099 or 044789007

- Email: [email protected]

Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).