First Home Buyer Rates: New Deals Below 5% 🏡

This is great news for you. Lenders are giving low rates. Some rates are now below 5%! This is good for people who want to buy a home.

Great Rates for You

The first home buyer rates are now very low. Unity Bank has a rate of 4.99%. So do G&C Mutual Bank and Horizon Bank. A variable rate can change. It can go up or down. These low rates are only for first-home buyers.

Refinancers Have Other Rules

The rules are different for refinancers. They have to meet stricter rules. The lowest rates are now starting below 5%. If you don’t have a deposit, then you would pay LVR. Otherwise, it can be hard to get a loan without a full 20% deposit if you don’t qualify for the Government scheme.

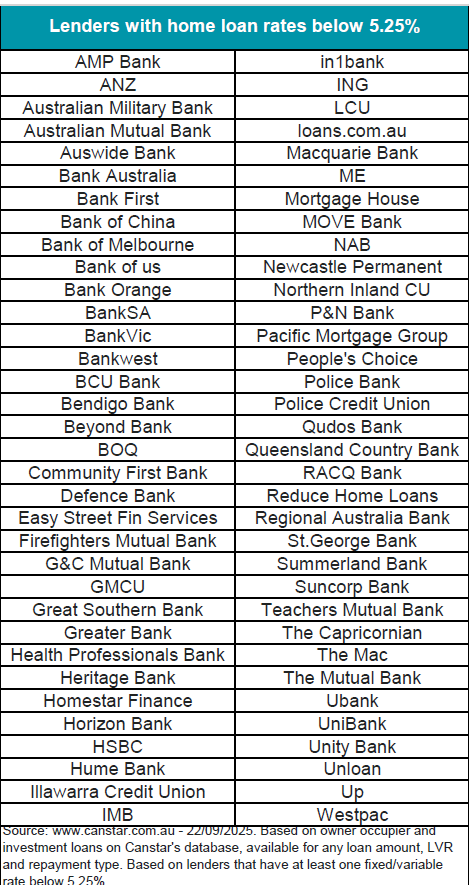

Big Banks Are Joining In

Even big banks are offering low fixed rates. CBA has a new fixed rate under 5%. Westpac also has low rates. The RBA is holding rates steady. But lenders are still competing. This is good for you.

What You Should Do

The market has many choices. A mortgage broker can help you. We know what each lender offers. We can help you find a great deal. We can check if you can get these low rates.

We can also help you with the new Home Guarantee Scheme changes. This can help you get a home with a small deposit.

Contact EZ Mortgage Broker today. We can help you start your home-buying journey.

- Phone: 1300 050 099 or 044789007

- Email: [email protected]