Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%.

This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions.

Which Banks Have Cut Rates?

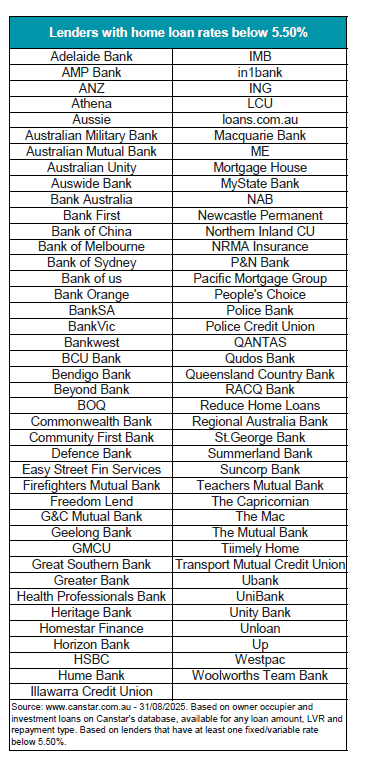

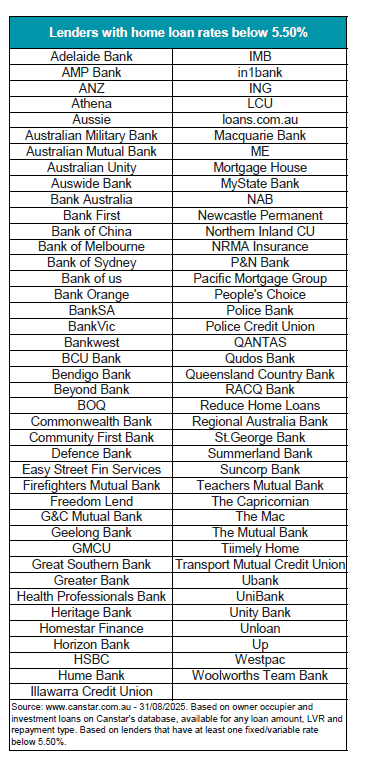

NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act.

Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut.

More Lenders Are Cutting Costs

Many other lenders also cut their rates. This includes:

- Great Southern Bank

- ING

- HSBC

- Bank of Queensland

- Heritage Bank

This shows a strong trend. Lenders are moving quickly to pass on lower rates.

How Can You Save Money?

This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive.

Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals.

Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

- Phone: 1300 050 099 or 044789007

- Email: [email protected]