RBA Holds Cash Rate, Homeowners Must Wait

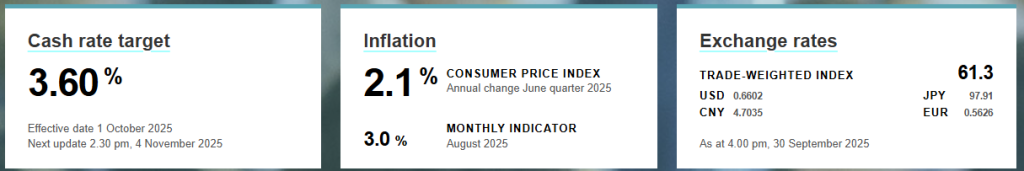

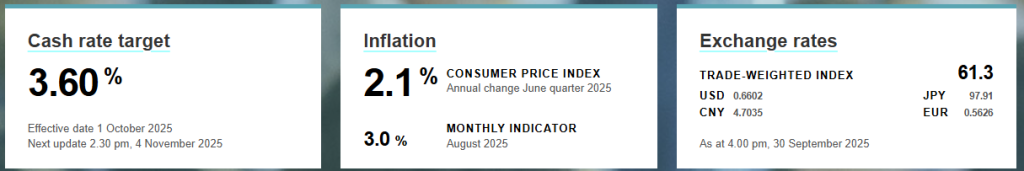

Homeowners will have to wait longer. They hope for a lower interest rate. The waiting will last until next year. The Reserve Bank of Australia (RBA holds cash rate) at 3.60 per cent. This news came out on Tuesday. Many experts thought this would happen. But homeowners are still upset. They want lower payments. The rate is the lowest since April 2023. This RBA holds cash rate decision, follows three cuts earlier this year.

Why Did the RBA Stop?

RBA boss Michele Bullock explained the choice. She said that bringing down inflation (rising prices) has slowed.

The RBA board gave two main reasons:

- People are spending: People and businesses are buying more things. This means companies can raise their prices easily.

- Prices Stick High: Overall price increases are okay (2–3 per cent). But prices for housing and services are still rising too fast.

The RBA will watch the new reports. Its next step depends on the data. The September inflation report (CPI) is very important. It comes out in late October. It will guide the next meeting in November.

What is a “Hawkish Hold”?

An economist named David Bassanese used a term: “hawkish hold.”

- A “hawk” central bank tries to slow the economy. This controls prices.

- This signal means the RBA is less likely to cut rates soon.

Another expert, Ivan Colhoun, agreed. He thinks a rate cut before Christmas is unlikely. This is because people are still spending a lot. RBA holds cash rate means a long wait. Homeowners must wait until mid-November for any change.

Ms. Bullock said the RBA is not trying to lower the prices themselves (deflation). Deflation is bad for business. They just want to slow the speed at which prices go up.

Some big banks predict a cut in November. But NAB thinks there will be no more cuts in 2025.

Contact Information

Do you need help with your home loan rate? Do you want to know how the RBA’s choice affects you? Please call or email a professional broker: Email: [email protected] Phone: 1300 050 099