RBA Rate Cut: How Banks Are Responding

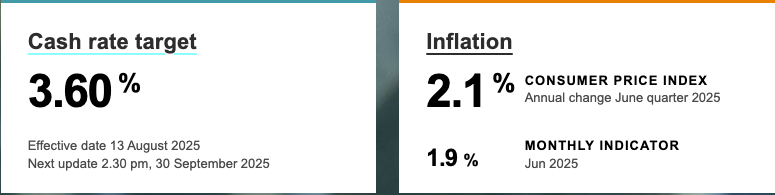

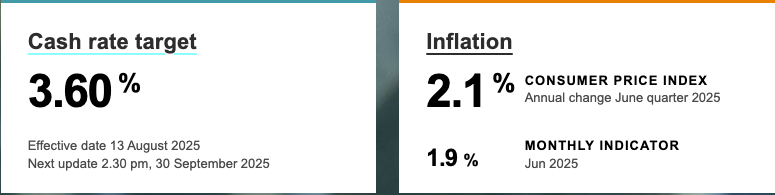

The Reserve Bank of Australia (RBA) has just cut the official cash rate by 0.25%. This is great news for many Australian homeowners! The new cash rate is now 3.60%.

The big question on everyone’s mind is: how will the banks respond? We are here to help you understand the changes and what they mean for your home loan.

The Big Four and Other Lenders

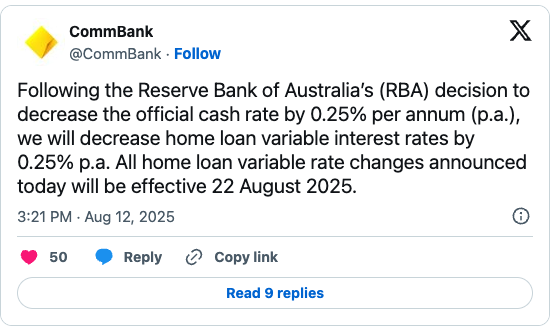

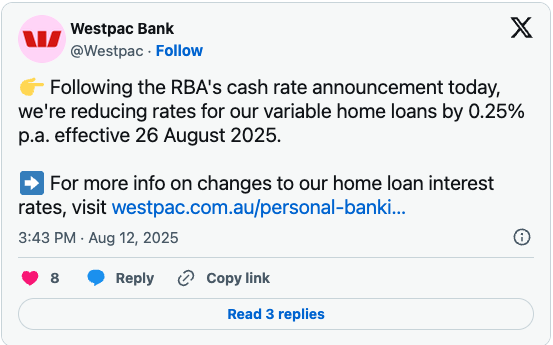

Right after the RBA’s announcement, several major banks quickly shared their plans.

- Macquarie Bank was one of the first. They said they would pass on the full cut to home loan customers. They are known for making these changes very fast.

- Commonwealth Bank (CBA) also announced they would pass on the full rate cut. They noted that this is the third rate cut this year, giving borrowers more room in their budgets.

- Westpac confirmed they would also be lowering their variable interest rates.

- ANZ followed suit, announcing a decrease in their variable interest rates for Australian home loans.

- Other lenders like St George and AMP have also announced they will pass on the 0.25% cut.

Will This Impact My Mortgage?

Yes! A rate cut of 0.25% can save you money. For example, on a $600,000 mortgage, this could save you about $90 a month if your bank passes on the cut in full.

But just because your bank cuts its rate doesn’t mean you have the best deal. This is the perfect time to review your home loan.

New Repayment Calculator

Fill in your details to see your personalized repayment comparison.

Loan Details

Contact Information

Your Repayment Comparison

Existing Repayment

$0.00

New Repayment

$0.00

Considering a Switch?

Thinking about moving to a new bank for a better deal? Before you do, here are some things to think about:

- Ask your current bank for a better deal. Tell them you are thinking of switching. They may lower your rate to keep you as a customer.

- Check the new loan terms. Some new loans may have a longer term (like 25 or 30 years).

- Look at lender's mortgage insurance (LMI). If you have less than 20% equity, you may have to pay LMI again.

This is where an expert mortgage broker can help. We can look at all these things for you. We will help you find the right loan, whether it's with your current bank or a new one.

Ready to Find a Better Rate?

Don't miss out on savings. Let an EZ Mortgage Broker help you find the best rate for your home loan.

Contact EZ MORTGAGE BROKER today for a free chat.

- Phone: 1300 050 099 or 044789007

- Email: [email protected]

Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).