RBA RATE CUT – Market Analysis For July 2025

After delivering its first interest rate reduction in over four years in February, followed by another in May, the Reserve Bank of Australia (RBA) is once again a focal point for financial markets. With inflation showing signs of moderating and the economy appearing to soften, many are keenly watching to see if the RBA will implement another RBA rate cut in July. We’ve gathered insights from expert forecasts, market indicators, and what these potential changes could signify for borrowers.

In May 2025, the RBA adjusted the official cash rate downwards by 25 basis points, moving it from 4.10% to 3.85%, building on the February reduction from 4.35%. These represented the initial cuts since 2020.

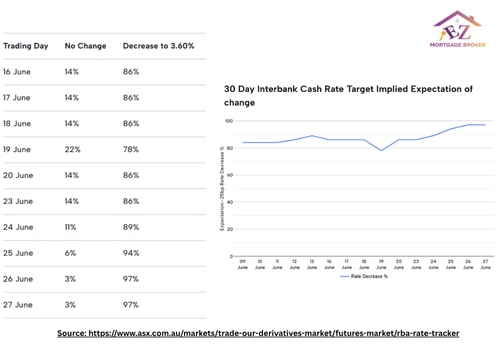

We now expect the next RBA rate cut to be in July rather than August, but this is not the shoo-in the market seems to think it is.

– Westpac

Why an RBA Rate Cut Appears Likely

The RBA is currently balancing declining inflation with a softening economy, making an

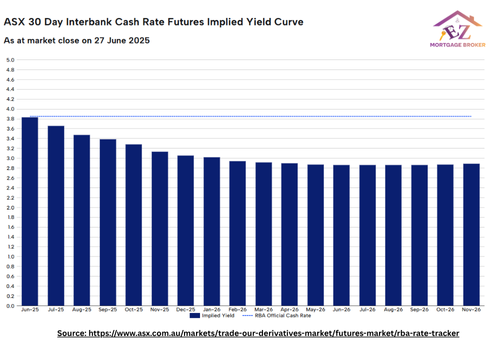

RBA rate cut increasingly probable. Recent data shows annual trimmed mean inflation eased to 2.4% year-on-year in May 2025, with headline CPI at 2.1%. New dwelling prices were flat in May after a previous rise, reducing upside risks to Q2 inflation. Market services inflation is also expected to ease. Economic indicators like GDP (0.2% Q1 2025) , weak business and consumer sentiment , and a steady unemployment rate (4.1% for five months) all point to contained inflationary pressures. Furthermore, easing energy price concerns due to the settled Israel-Iran conflict, alongside a still restrictive cash rate (3.85% vs. neutral estimates around 3.35%), provide additional room for the RBA to ease policy and prevent inflation from undershooting its target.

What Leading Banks Project for the RBA Rate Cut

Australia’s major banks have varied, yet generally consistent, forecasts regarding the RBA rate cut:

-

Westpac anticipates the RBA will hold in July, then proceed with cuts in August and November, projecting the cash rate to reach 3.35% by year-end, with additional reductions possibly extending into early 2026. Westpac highlights the RBA’s preference for “cautious and predictable” adjustments.

-

NAB foresees a cut in July, followed by further reductions in August and November, aiming for a terminal rate of 3.10%.

- Commonwealth Bank (CBA) has adjusted its base case to now expect an RBA rate cut by 25 basis points to 3.60% at its 7-8 July meeting, with a subsequent 25 basis point cut in August. Their previous expectation was for cuts in August and September, but the recent data flow provided comfort for a swifter return to neutral.

-

ANZ projects two rate reductions this year, around August and later, which would bring the cash rate to approximately 3.35%.

Collectively, the consensus among the big four banks points to multiple cuts before the end of the year, with NAB and CBA now explicitly forecasting an RBA rate cut in July.

Even if the RBA reduces rates in July, it’s important to remember that banks may not immediately pass on the full cut to variable rates, and for those on fixed-term loans, any changes to repayments might not be immediate.

However, for a $650,000 mortgage, securing a rate like 5.29% could potentially lead to hundreds in monthly savings compared to an average variable rate. Furthermore, by maintaining your current repayment amount rather than reducing it, you could not only save on interest but also shorten the overall term of your loan.

*Based on averages collected by the Australian Bureau of Statistics and the Reserve Bank of Australia.

Here’s an illustration of how a 0.25% RBA rate cut (e.g., from 6.26% to 6.01%) could influence monthly repayments for various loan sizes:

|

Loan Value* |

Monthly Repayment (6.25%) |

Monthly Repayment (5.29%) |

Potential Annual Savings** |

|

$450,000 |

$2,969 |

$2,707 |

$4,320 |

|

$500,000 |

$3,298 |

$3,008 |

$4,800 |

|

$650,000 |

$4,288 |

$3,910 |

$6,240 |

|

$1,000,000 |

$6,597 |

$6,016 |

$9,600 |

Conclusion

This potential for savings isn’t only beneficial for those looking to refinance. When banks proactively trim fixed rates, it often signals their anticipation of more favorable lending conditions and a desire to remain competitive in a cooling market. If you’re considering refinancing, debt consolidation, or simply aiming for a better deal, now could be an opportune moment to explore your options.

Need Assistance with Your Home Loan Review?

Regardless of the upcoming rate decisions, it’s always a good strategy to consult with Ez Mortgage Broker. So we can:

-

Help you understand how the July decision might impact your repayments.

-

Verify if your current lender is fully passing on any rate reductions.

-

Investigate refinancing opportunities available in the current market.

Consider booking a free appointment with a qualified broker today.

3 Comments

Comments are closed.

Aute mi ut suspendisse velit leo, vel risus ac. Amet dui dignissim fermentum malesuada auctor volutpat, vestibulum ipsum nulla.

Sed reprehenderit quam, non felis, erat cum a, gravida lorem a. Ultricies in pellentesque ipsum arcu ipsum ridiculus velit magna, ut a elit est. Ultricies metus arcu sed massa. Massa suspendisse lorem turpis ac.

Massa suspendisse lorem turpis ac. Pellentesque volutpat faucibus pellentesque velit in, leo odio molestie, magnis vitae condimentum.