SMSF Loans for Property: Your Guide to Expert Lending Solutions for Property Investment

SMSF Loans for Property: Your Guide to Expert Lending Solutions for Property Investment

Do you want to save for retirement? A Self-Managed Super Fund (SMSF) might be a good choice. With an SMSF, you control your super. You choose where to invest. This includes buying property. SMSF loans let you use your super to buy property for your retirement.

But SMSF loans can be complex. They can even be frustrating. At SMSF Loan Experts, we are here to simplify the process and find you the best tailored lending solution.

What We Offer: Tailored SMSF Lending Solutions

We help you in many key ways:

- Maximise Your Borrowing: We help your SMSF borrow as much as it can. This can lead to higher returns for your investment.

- Check Your SMSF Structure: We review your SMSF. We make sure it is right for lending. This helps you stay compliant and lowers costs.

- Decide Your Best Strategy: We work with your unique needs. This includes your money situation and goals. We find the most effective plan for you.

- Match You with the Right Lender: We work with over 17 SMSF lenders. We find the one that fits your strategy.

- Secure Competitive Loans: We have our own credit license. This means we can access very competitive loans. These loans have low fees and interest rates.

- Guide You Through Documents: The paperwork required for SMSF loans is complex and time-consuming. Our goal is to make this process as painless as possible.

- Prepare and Lodge Your Application: We make sure all details are correct. We ensure they follow ATO rules. Then we submit your loan application.

- Liaise for Quick Approval: We talk to the lender for you. Our goal is to get your loan approved fast. We have seen loans settled in under 2 weeks.

- Help with Loan Document Signing: Some complex papers need legal advice. Certain forms need a licensed financial advisor to witness them. We can organise both of these through our partnered firms.

- Coordinate Settlement: We help manage the final steps. This means you can focus on saving for your retirement!

Understanding SMSF Loans

An SMSF is a private super fund. You manage it yourself. It gives you more freedom. You can hold many assets like shares, cash, and investment properties.

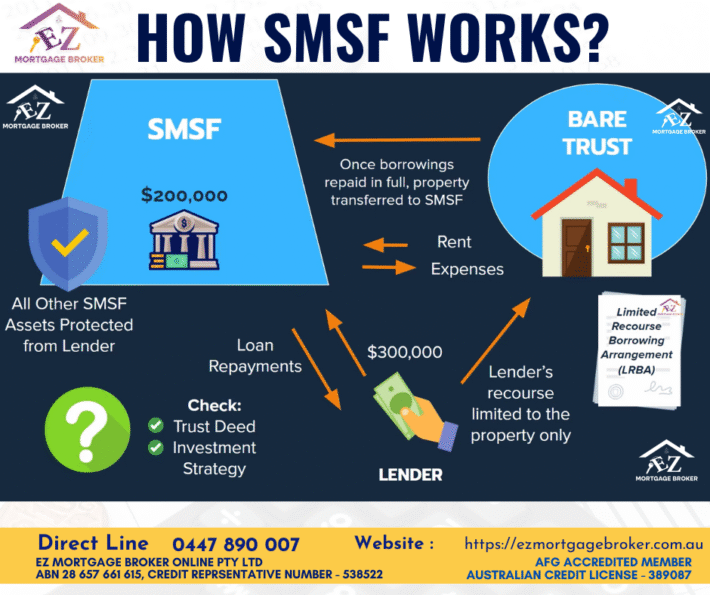

How does an SMSF home loan work? SMSF loans are also called Limited Recourse Borrowing Arrangements (LRBAs). They help SMSF trustees borrow money. This is to buy an investment property. The property is held in a special trust. The lender’s claim is only on that property. This protects other super assets.

Refinancing Your SMSF Loan: If your current loan is more than 2 years old, you could get a better deal. We compare new products to find a more cost-effective loan for you.

Setting Up Your SMSF for Lending: We help ensure your SMSF is set up correctly. This means it is compliant. We provide help from fund setup to property settlement. We can even get your loan pre-approved before your super fund has been established.

Commercial SMSF Property Loans: Looking to buy a business property with your super? We help you access commercial loan products. We build a tailored investment strategy for your SMSF business property.

Bad Credit SMSF Loans: Having a bad credit score does not mean you miss out. We offer SMSF loan solutions for clients with a less-than-perfect credit history. This helps you invest without high interest rates.

Important Things to Consider

- Minimum Balance: We recommend having at least $200,000 in cash and shares in your SMSF. This helps with purchases and liquidity.

- Property Types: You can buy homes (houses, duplexes, units – not serviced apartments) or business properties (shops, offices, warehouses).

- The property must be for investment only. If it’s a home, you must rent it out fairly.

- You cannot buy a development property (e.g., vacant land or construction projects).

- It must meet the ATO’s ‘sole purpose test’.

- You cannot live in the property or have a related person live in it.

- Business properties can be leased to a member’s business at the market rate.

- Only one title per contract is allowed when buying property.

- Loan Structure: The LRBA limits the lender’s claim only to the property. Lenders check expected rent, investment income, and past super payments to check affordability.

- Offset Accounts: We do not recommend offset facilities for SMSF loans. This is due to unclear rules and potential compliance risks.

Get SMSF Home Loan Advice from an Expert!

SMSF loans are complex. Many mortgage brokers are not familiar with them. Always use a broker with real experience and knowledge.

Don’t go into the complex world of SMSF loans alone. Contact SMSF Loan Experts today. We have 15 years of experience in SMSF setup and lending across Australia. Get personalised advice. We can help you secure the right SMSF home loan.

Contact Us: Phone: 1300 050 099 Email: [email protected] Website: www.ezmortgagebroker.com.au