RBA’s Shock Hold: Why the Rate Cut Didn’t Happen

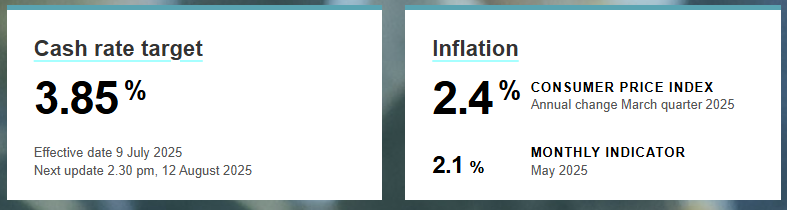

Melbourne, Australia – July 8, 2025 – Many people hoped for a lower interest rate, but the Reserve Bank of Australia (RBA) surprised everyone. Today, they kept the official cash rate at 3.85%. This was a shock because most people thought they would cut rates.

“The RBA board decided to hold the cash rate steady at 3.85%, defying market expectations of a 25 basis point cut and disappointing mortgage holders who were expecting a rate reprieve.” – Ez Mortgage Broker

The RBA’s announcement came out at 2:32 PM AEST. Later, Governor Michele Bullock explained why. She said the RBA wants to be careful and take its time. They need “a little more information” before cutting rates again.

RBA Reasons for Rate Hold: Why No Cut?

Governor Michele Bullock told us why the RBA board made this choice. It wasn’t about if rates would go down, but when. The board even had different ideas; six voted to keep rates the same, and three wanted a cut. Here are the main RBA reasons for rate hold:

- Waiting for Key Inflation Numbers: Inflation is how much prices go up. The RBA watches this closely. Monthly inflation recently dropped into their target range (2.4% in May). But the RBA wants to see quarterly inflation. This number is more complete. Governor Bullock said this number has “only been in our 2-3 % target range for one quarter.” They are waiting for the June quarter Consumer Price Index (CPI) data, which comes out at the end of July. This data will help them see if prices are really going down in a lasting way.

- Worries About the World Economy: The RBA is also worried about what’s happening around the world. They mentioned “heightened level of uncertainty.” This includes new trade policies and taxes from other countries, like the US. These could hurt the global economy. Bullock said that while they are not keeping rates high just in case, having rates where they are gives them “more room to move” if big global problems happen.

- Checking How the Local Economy is Doing: The RBA also wants to “wait a few weeks to confirm that we’re still on track to meet our inflation and employment objectives.” This means they want more information on jobs and how their past rate cuts are affecting the economy. They want to be sure everything is going as planned before cutting rates again.

Bullock made it clear: the RBA isn’t trying to keep rates high on purpose. They are simply “reacting to the domestic inflation data and the employment data.” She also said it wouldn’t be right to tell the market about the decision before the board meeting.

What This Means for You and What’s Next

If you own a home, this news might mean that house prices won’t go up as fast. Anne Flaherty, an expert economist, said that today’s decision “may slow the pace of price growth seen in the months following the February and May cuts.” Still, most experts believe rates will be cut later this year.

For those with mortgages, it means no immediate relief. But Governor Bullock hinted strongly that an August cut is possible. This depends on the new inflation data. “If it comes in as we think it will, continued decline, then that validates our easing path,” she explained. So, watch for the August meeting!

Need Help with Your Mortgage?

It’s normal for RBA decisions to be confusing. Knowing how they affect your mortgage is important.

Contact Ez Mortgage Broker today for clear advice:

- Call us: 0447890007 or 1300 050 099

- Email us: [email protected]

Our team can help you understand these changes and find the best home loan options for you.