How Your SMSF Can Buy Property: A Simple Visual Guide

How Your SMSF Can Buy Property: A Simple Visual Guide

Do you dream of buying property with your super money? It’s possible! A Self-Managed Super Fund (SMSF) can help. But it has special rules. This guide, with a clear picture, will show you how SMSF property investment works.

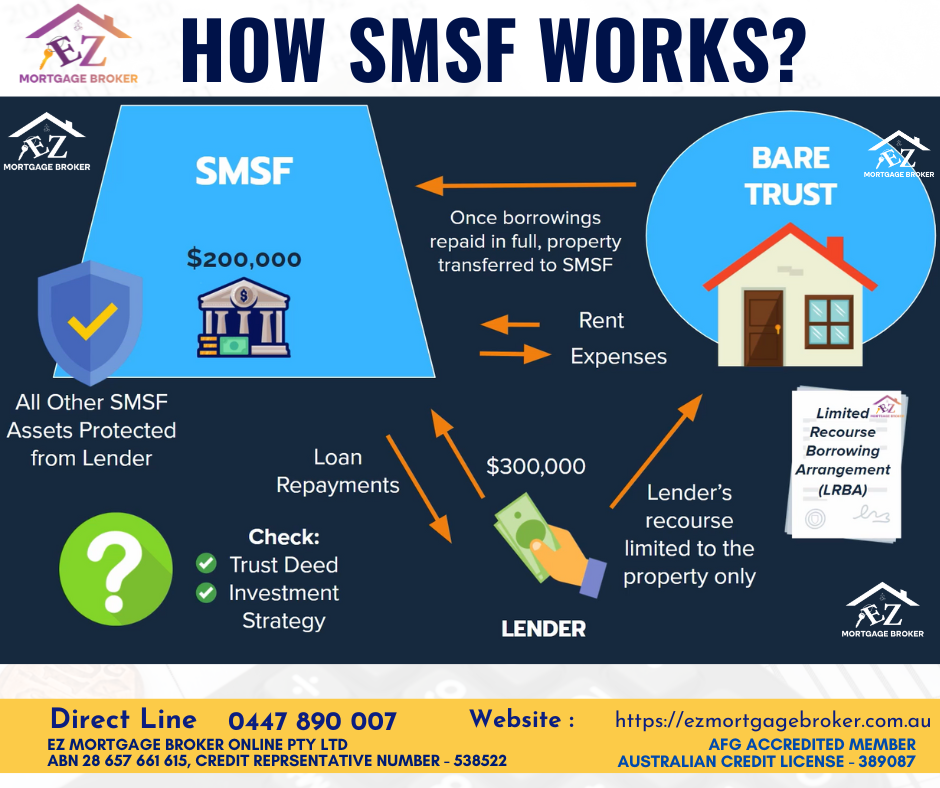

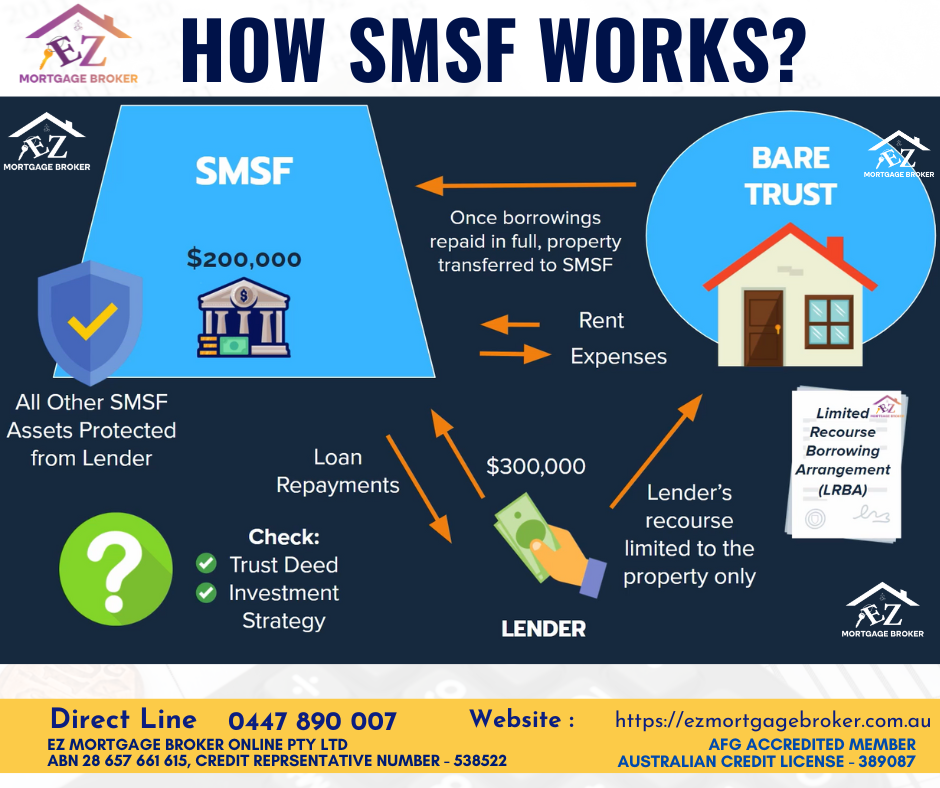

Let’s look at the diagram below. It shows the main parts of an SMSF buying property.o be organised. You must follow many rules. The ATO (Australian Tax Office) checks SMSFs closely.

This diagram simplifies how your Self-Managed Super Fund (SMSF) can borrow to invest in property. It illustrates the key roles of the Bare Trust and Limited Recourse Borrowing Arrangement (LRBA) in protecting your other super assets while building your retirement wealth.

Understanding the SMSF Property Picture

The image shows how an SMSF can borrow money. This money is used to buy property. Here are the key steps:

- Your SMSF: This is your super fund. It has money, maybe $200,000 as shown. Importantly, the diagram shows a shield. This means other money in your SMSF is safe. It’s protected from the lender.

- The Lender: This is a bank or financial group. They lend money, like the $300,000 shown. Your SMSF will make “Loan Repayments” to them.

- Bare Trust & Property: This is very important. When an SMSF borrows to buy property, the property isn’t owned directly by the SMSF at first. It’s held by a “Bare Trust.” Think of the Bare Trust as a holding place. It holds the property for your SMSF.

- Limited Recourse Borrowing Arrangement (LRBA): This is the special loan type. The diagram shows it. An LRBA means the lender’s risk is limited. If something goes wrong, they can only take back the property bought. They cannot touch other assets inside your SMSF. This protects your other super savings.

The Money Flow and What Happens Next

- Rent & Expenses: Once the SMSF buys the property, it will get rent. This rent goes into your SMSF. Your SMSF also pays for property expenses. These might include rates or repairs.

- Property Transfer: The diagram shows an arrow. It says, “Once borrowings repaid in full, property transferred to SMSF.” This means once the loan is fully paid off, the property moves from the Bare Trust to be fully owned by your SMSF.

Before You Start: Checks to Make

The image also shows a question mark. It reminds you to “Check: Trust Deed, Investment Strategy.” These are crucial:

- Trust Deed: Your SMSF’s rule book. It must allow you to borrow for property.

- Investment Strategy: Your plan for how your SMSF will invest. It needs to include property.

Is SMSF Property Investment for You?

SMSF property investment can be very rewarding. But it’s also complex. You need to understand the rules. You need to manage the fund well. The ATO (Australian Tax Office) has strict rules for SMSFs.

Thinking about this for your super? It’s important to get expert help. Ez Mortgage Broker can guide you. We can help you understand the SMSF rules. We work with trusted financial advisors. They can tell you if SMSF property investment is right for your goals. They can also explain the steps.

Ready to talk about your super and property dreams? We are here to help you make smart choices. Learn more about how we assist with financial planning and property finance on our Services Page.

Contact Ez Mortgage Broker today:

- Phone: 0447 890 007 or 1300 050 099

- Email: [email protected]

Let us help you build a strong financial future, right from Melbourne