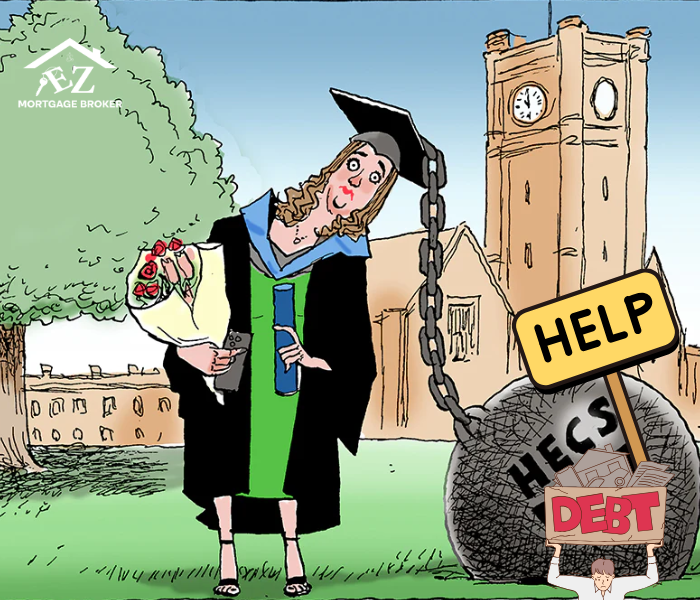

Easier Home Loans! NAB Joins CBA on HECS/HELP Debt

Got a HECS HELP Home Loan on your mind? If you’re hoping to buy a place in Tarneit, Truganina, Wyndham City, Melbourne, Melton, Rockbank, or anywhere in Australia, and you have student debt, we have exciting news!

NAB Helps Home Buyers with Student Debt

National Australia Bank (NAB) just changed how they look at home loan applications. If your HECS HELP Home Loan debt is $20,000 or less, it won’t count against how much you can borrow with NAB. This starts on July 31st, 2025.

Why is this a big deal? Banks usually check all your income and debts to see how much they’ll lend. By not counting smaller student debts, NAB helps many people borrow more. This means more Australians can buy a home!

CBA Started This Trend

NAB is following the lead of Commonwealth Bank (CBA). In April, CBA also began ignoring HELP debt for home loans. They did this if you could pay off your debt in 12 months. CBA is even looking into plans for those who can pay off their loans in one to five years. This shows major banks want to help first-time home buyers.

NAB’s Matt Dawson, who works in home ownership, said this change “will make a real difference for first-home buyers.” He added, “For too long HELP debt has been a roadblock for many Australians looking to buy a home.”

This change comes after the government asked financial regulators to update their rules on student debts. The Australian Prudential Regulation Authority (APRA) confirmed these changes will start on September 30, 2025.

Government Helps with Debt Too!

On top of the bank changes, the Australian government also announced plans for HECS/HELP debt. Their new law aims to cut 20% off three million graduates’ HELP debt. This is about $16 billion in total relief!

For example, the average HELP debt is $27,600. If the new law passes, $5,520 could be wiped off that amount. The government also plans to raise the income limit for starting student loan repayments from $54,000 to $67,000.

What Does This Mean for Your Home Dream?

These changes from both banks and the government make it much easier to get a home loan. This is especially true for first-time buyers with HECS HELP Home Loan debt.

While getting enough houses is still a challenge, these steps help more Australians buy a home.

Ready to Find Your Home Loan?

Getting a home loan can seem tricky. But with these new rules, buying a home might be easier than you think! At EZ MORTGAGE BROKER, we know all the latest changes. If you’re in Tarneit, Truganina, Wyndham City, Melbourne, Melton, Rockbank, or anywhere else in Australia, we can help. We’ll show you how these changes affect you and find the best home loan options.

Contact EZ MORTGAGE BROKER today on 1300 050 099 or [email protected] for a free consultation and let’s turn your homeownership dreams into reality!