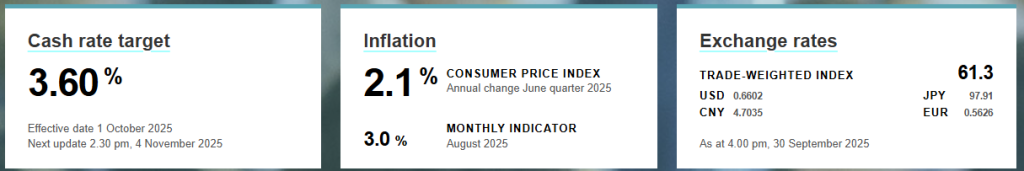

The RBA has kept the official cash rate at 3.60%, delaying relief for mortgage holders. Governor Bullock cited slowing inflation progress and sticky prices as reasons for the “hawkish hold.”

First Home Buyer Rates: New Deals Below 5% 🏡

New first home buyer rates are hitting 4.99% as competition heats up. Learn how to get the best deal, what it means for refinancers, and how a broker can help you.

ASIC Halts Mortgage Fund: What It Means for Investors

The Australian Securities and Investments Commission (ASIC) has stopped a mortgage fund. This fund is called the RELI Capital Mortgage Fund. ASIC took this step to protect everyday investors. ASIC wants to make sure people do not buy financial products that are not right for them. Why ASIC Took Action This decision came after ASIC looked closely at private credit funds. They found some issues with the fund’s paperwork. This document is called a Target Market Determination (TMD). It tells who the fund is for. ASIC had several concerns: Because of these concerns, ASIC has put a temporary stop to the fund. This means RELI Capital cannot sell the fund to new retail investors. They also cannot give advice that recommends it. The order lasts for 21 days. This gives RELI Capital time to fix the problems. What This Means for You This action shows that ASIC is serious about protecting investors. They want to make sure funds are clear about their risks. They also want to make sure funds are sold to the right people. If you are already invested in the RELI Capital Mortgage Fund, ASIC advises you to review your investment. Make sure it still fits your financial goals and your comfort with risk. For anyone thinking about investing, it’s a reminder to always understand what you are buying. Consider the risks and if it truly suits your needs. <img src=”https://storage.googleapis.com/gcp-bucket-5392500/asic_halts_mortgage_fund.png” alt=”An image showing a red stop sign over a house with dollar signs, representing ASIC halting a mortgage fund for investor protection.”> If you are unsure about your investments or home loan, talk to a trusted expert. An EZ Mortgage Broker can help you understand your options and connect you with the right professionals for financial advice. Contact EZ Mortgage Broker today for a free chat.

We Are Growing Fast. What This Means for You

Mortgage brokers have a record market share, and the fastest growing mortgage brokerages are succeeding by focusing on clients. We explain what this means for you.

Mortgage Stress: When to Walk Away 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path.

Mortgage Stress: When to Walk Away 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path.

Mortgage Stress: When to Walk Away 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path

Mortgage Stress: When Is It Time to Walk Away? 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path.

Lenders Slash Mortgage Rates: More Relief for Borrowers 💰

There is great news for Australian homeowners. Lenders slash mortgage rates across the country. More than 25 lenders have cut their rates. This is a chance for big savings. Now is a perfect time to review your home loan. In short: Mortgage rates are falling across Australia. Many lenders are cutting their rates. This gives homeowners a great chance to save money on their loans. The market is very competitive. It’s a great time to refinance or find a better deal. Ez Mortgage Broker What Is Happening? Lenders are cutting rates. Twenty-five lenders made changes. They lowered 221 variable rates. These cuts averaged 0.27%. Eleven lenders also lowered 154 fixed rates. Their average cut was 0.35%. This shows a strong trend. Lenders want your business. The Lowest Rates The average variable rate is 6.1%. But even lower rates are available. Horizon Bank offers a rate of 4.99%. This is a very competitive rate. You can find many loans under 5.5% now. Over 1,100 loans are below this rate. Lenders That Have Cut Rates Here are some lenders who cut rates recently: Rates are subject to change. Please contact us for the most up-to-date information. Why Act Now? A lower rate can save you money. It can also help you pay off your loan faster. The market is very active. It is a good time to refinance. Don’t miss this chance to save. Our team at EZ Mortgage Broker can help you. We find the best deals for you. We can check your current loan. We can find a better option. It is a free check-up. Contact us today! We can help you navigate these changes.

Home Guarantee Scheme Changes Are Coming! (1st Oct 2025) 🏡

Great news for home buyers! The Home Guarantee Scheme changes are coming soon. They will start on October 1st. This means more people can buy a home. The Big Changes How Can You Apply? The scheme helps you buy a home with a small deposit. You need at least a 5% deposit. The government will help with the rest. This lets you avoid Lenders Mortgage Insurance (LMI). You can apply through a lender. We can help with this. We will check your eligibility. We will guide you through the process. To find out more about the Scheme and view Housing Australia’s Frequently Asked Questions, visit the Housing Australia website here. Also, the Housing Australia Investment Mandate Amendment to effect these changes can be found here. What You Need to Know There are some rules you must follow. You must be an Australian citizen or permanent resident. You must also be 18 years or older. You must also live in the home you buy. You cannot rent it out. This scheme helps you save money and buy a home sooner. The Prime Minister said the goal is to help more people own a home sooner. Contact EZ Mortgage Broker today for a free chat. We can help you start your home buying journey. Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).