As of August 2025, mortgage rates are starting to fall. But did the RBA wait too long? Learn what this means for your home loan.

New Home Loans Up, Refinancing Soars in FY25: What It Means for You in Melbourne

New loan activity and refinancing saw big jumps in FY25. Discover what this PEXA report reveals for your home loan in Melbourne and surrounding areas.

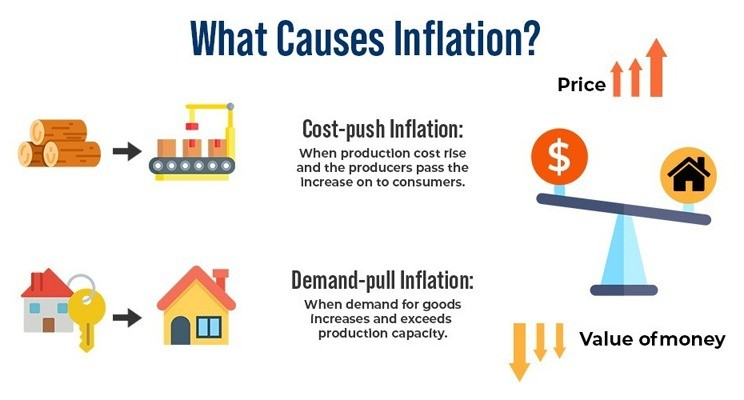

RBA Rate Cut Hopes for Tarneit Homeowners Hang on Inflation Data

Homeowners are eager for RBA rate cuts. But the central bank is waiting for key inflation data. EZ MORTGAGE BROKER explains what this means for your loan in Tarneit and Melbourne.

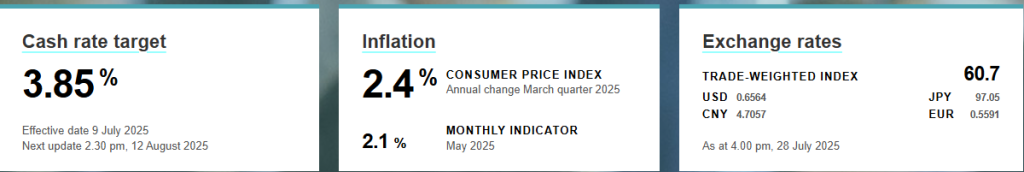

Easy Guide: Melbourne Home Loan Rates Today (July 2025)

Learn about current Mortgage Rates Melbourne as of July 2025. Get simple advice on fixed vs variable loans and how to get the best rate.

Your Guide to the Melbourne Property Market: 7 Simple Facts

Unpack the Australian property market with 7 easy-to-understand facts. Learn how trends impact Melbourne, Tarneit, and Western suburbs.

Mortgage Stress Tarneit: Get Help Now

Mortgage stress is growing in Australia. It affects homes in Tarneit, Wyndham, and Melbourne. Find out why. EZ MORTGAGE BROKER offers support.

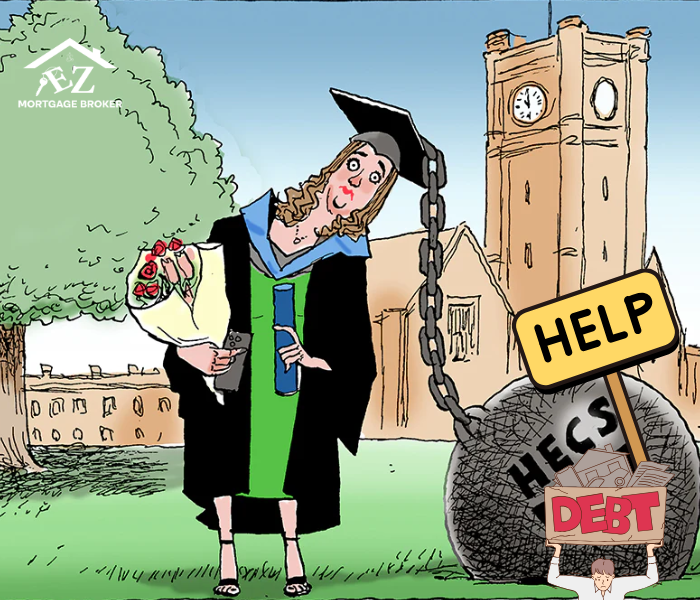

Easier Home Loans! NAB Joins CBA on HECS/HELP Debt

Great news for Australian homebuyers, especially those with HECS/HELP debt! NAB has announced changes that will make it easier to qualify for a home loan, following in the footsteps of CBA. Find out how this could help you get into your dream home sooner.

Mortgage Stress Australia: Your Ez Guide Amidst Rising Pressures

Australian homeowners are experiencing rising mortgage stress, even after two interest rate cuts this year. While rates are lower, the need for larger loans and the persistent serviceability buffer are creating hidden pressures.

Home Loan Rates Hold Fire: What June’s Job Figures Mean for Borrowers in Australia

Ten days after the RBA’s unexpected July cash rate hold, home lenders are largely quiet. But with a significant jump in June’s unemployment, the market is bracing for a likely August rate cut. Discover what’s happening in home loans.

Australian Mortgage Market Competition: What You Need to Know

Australia’s mortgage market is undergoing significant changes, leading to increased competition among lenders and new opportunities for borrowers.