Unsure about current mortgage rates in Tarneit, Truganina, or wider Melbourne? Get the latest RBA cash rate insights for July 16, 2025, and see what it means for your home loan. Find your best rate with EZ Mortgage Broker.

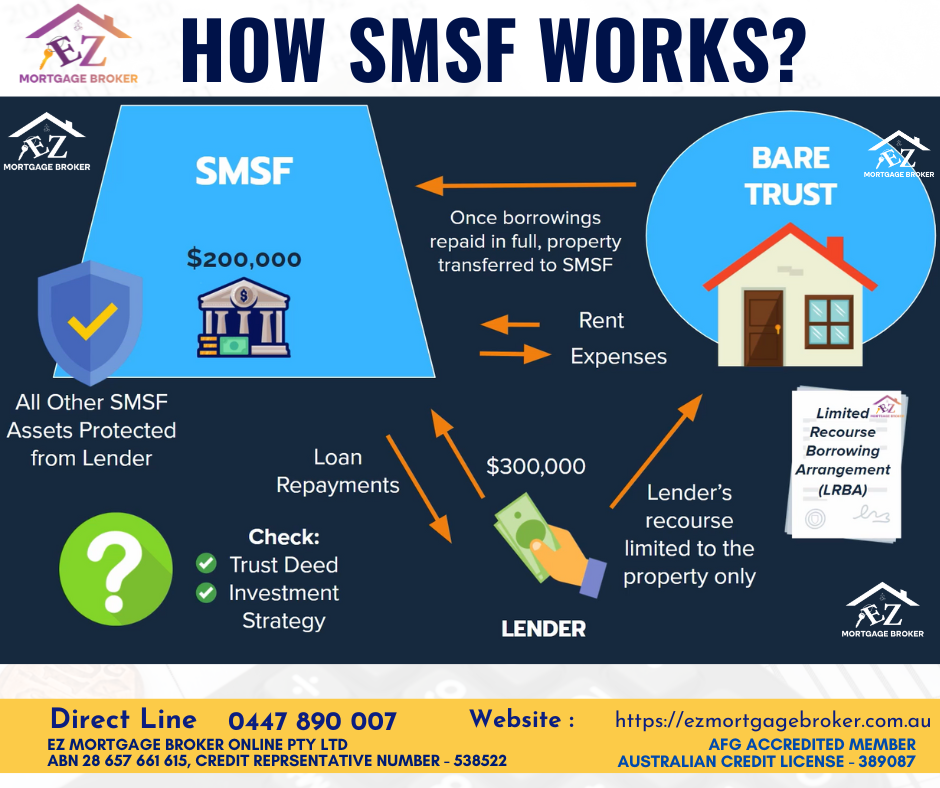

How Your SMSF Can Buy Property: A Simple Visual Guide

Want to use your super for property? This simple guide, with a clear image, shows how SMSF property investment works and what you need to know.

RBA Interest Rate Hold Mortgage: Your Repayment Guide

The RBA’s recent decision to hold the cash rate at 3.85% might leave some Australian mortgage holders feeling the pinch. While rate cuts can take time to fully impact household budgets, many are choosing to maintain higher repayments.

Auction Warning: No Cooling-Off Means Pre-Approved is Must!

Planning to buy at auction? The “no cooling-off” rule is critical. Discover why this means immediate commitment and why auction no cooling off makes pre-approval a must-have.

RBA’s Shock Hold: Why the Rate Cut Didn’t Happen

The RBA surprised markets by holding the cash rate at 3.85% in July 2025. Discover the core RBA reasons for rate hold, including the need for more data and global uncertainties.

RBA Rate Decision Today: What a Cut Could Mean for Your Mortgage

The RBA’s interest rate decision is today. Many predict a cut, bringing good news for homeowners. Learn how potential RBA rate cut savings could affect your budget.

Lower Rates Don’t Mean Automatic Lower Mortgage Repayments

When interest rates drop, your mortgage payments might not automatically lower. Banks often require you to take action. Learn more here.

Australian Home Prices Record New Highs in June 2025: Your Simple Guide

Australian Home Prices Record new highs in June 2025! Find out what this means for you and how EZ Mortgage Broker can help.

Big Savings Coming! RBA to Cut Rates This Tuesday

Get ready for good news! The Reserve Bank of Australia is likely to cut interest rates this Tuesday. This could mean big savings for your home loan.

Westpac Self-Employed Loans: Easier Home Buying Now!

Great news for self-employed Australians! Westpac has changed its home loan rules. Getting Westpac self-employed loans is now much simpler. Read on to find out how this helps you.