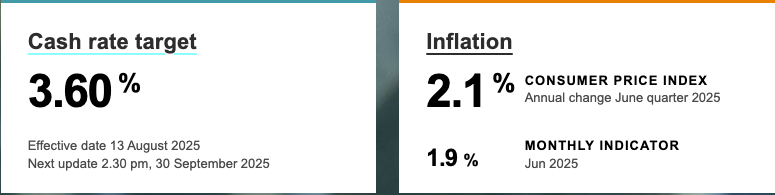

The RBA has cut its cash rate, and major banks like Commonwealth, ANZ, and Macquarie are responding. While this could mean savings for many, it’s also the perfect time to review your home loan to ensure you’re getting the best possible deal. Find out what this RBA rate cut response means for your mortgage.

Mortgage Rates are Coming Down: Is It Too Late for the Australian Economy?

As of August 2025, mortgage rates are starting to fall. But did the RBA wait too long? Learn what this means for your home loan.

RBA Interest Rate Hold Mortgage: Your Repayment Guide

The RBA’s recent decision to hold the cash rate at 3.85% might leave some Australian mortgage holders feeling the pinch. While rate cuts can take time to fully impact household budgets, many are choosing to maintain higher repayments.

Lower Rates Don’t Mean Automatic Lower Mortgage Repayments

When interest rates drop, your mortgage payments might not automatically lower. Banks often require you to take action. Learn more here.

Big Savings Coming! RBA to Cut Rates This Tuesday

Get ready for good news! The Reserve Bank of Australia is likely to cut interest rates this Tuesday. This could mean big savings for your home loan.

Mortgage Game-Changer: RBA Rate Cut on the Horizon & Fixed Rates Below 5%!

Big news for Australian homeowners! ANZ has slashed fixed rates, hinting at an RBA cut. Even better, a growing number of lenders are now offering fixed rates below 5%!

RBA RATE CUT – Market Analysis For July 2025

The Reserve Bank of Australia (RBA) is expected to cut the cash rate in July and August 2025. This blog post will explain what this means for you.