Great news for Australian homebuyers, especially those with HECS/HELP debt! NAB has announced changes that will make it easier to qualify for a home loan, following in the footsteps of CBA. Find out how this could help you get into your dream home sooner.

Mortgage Rates & Inflation

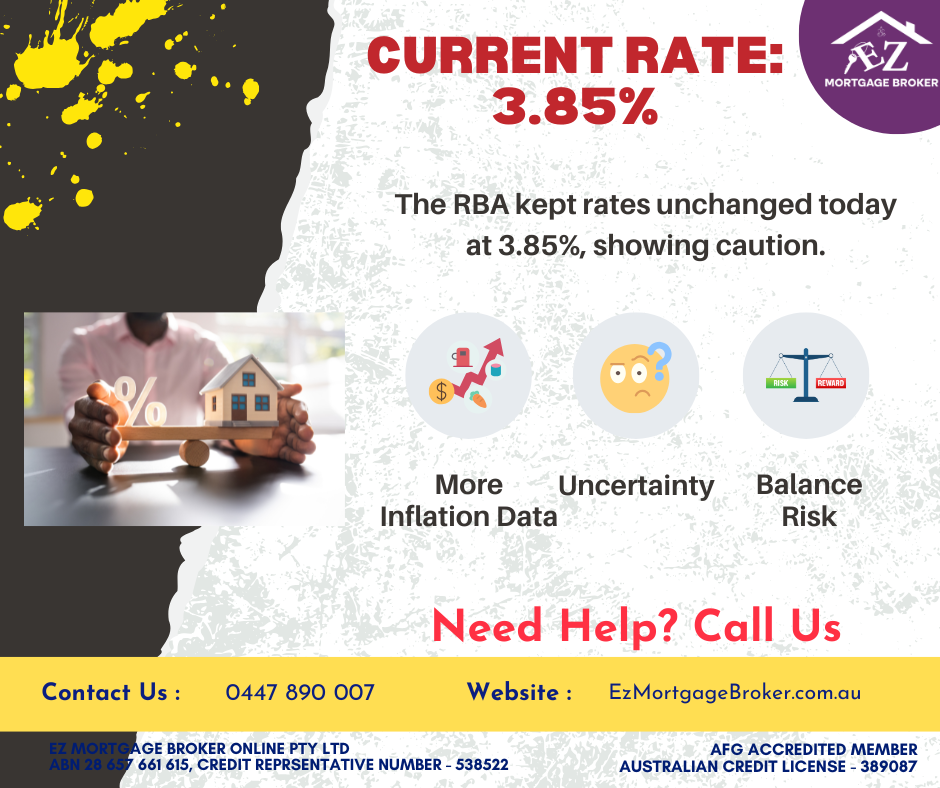

Unsure about current mortgage rates in Tarneit, Truganina, or wider Melbourne? Get the latest RBA cash rate insights for July 16, 2025, and see what it means for your home loan. Find your best rate with EZ Mortgage Broker.

RBA Interest Rate Hold Mortgage: Your Repayment Guide

The RBA’s recent decision to hold the cash rate at 3.85% might leave some Australian mortgage holders feeling the pinch. While rate cuts can take time to fully impact household budgets, many are choosing to maintain higher repayments.

RBA’s Shock Hold: Why the Rate Cut Didn’t Happen

The RBA surprised markets by holding the cash rate at 3.85% in July 2025. Discover the core RBA reasons for rate hold, including the need for more data and global uncertainties.

Big Savings Coming! RBA to Cut Rates This Tuesday

Get ready for good news! The Reserve Bank of Australia is likely to cut interest rates this Tuesday. This could mean big savings for your home loan.

Westpac Self-Employed Loans: Easier Home Buying Now!

Great news for self-employed Australians! Westpac has changed its home loan rules. Getting Westpac self-employed loans is now much simpler. Read on to find out how this helps you.