Dreaming of owning your first home sooner? The first home buyer 5 deposit scheme is launching early this October! Buy with just a 5% deposit and skip LMI. Learn more!

Australian Mortgage Savings: Rate Cuts Are Here! 💰

Major banks are cutting rates, bringing significant Australian mortgage savings. Learn what this means for your home loan and how a broker can help you get the best deal.

Big Four Banks Rate Cut: What It Means For You 💰

The big four banks rate cut is finally here, bringing savings to millions. But some lenders are much faster than others. Learn what this rate cut means for your home loan.

Home Buyer Sentiment is the Highest in 4 Years!

Home buyer sentiment has reached its highest point in over four years, thanks to recent rate cuts. This rising confidence is a strong signal for the housing market. Learn how we can help you take advantage of it.

The Real Cost of Lower Mortgage Repayments 💸

New research shows that accepting lower mortgage repayments after a rate cut could cost you thousands. Learn why keeping your repayments the same can save you a fortune and help you pay off your home loan years sooner.

Easier Home Loans! NAB Joins CBA on HECS/HELP Debt

Great news for Australian homebuyers, especially those with HECS/HELP debt! NAB has announced changes that will make it easier to qualify for a home loan, following in the footsteps of CBA. Find out how this could help you get into your dream home sooner.

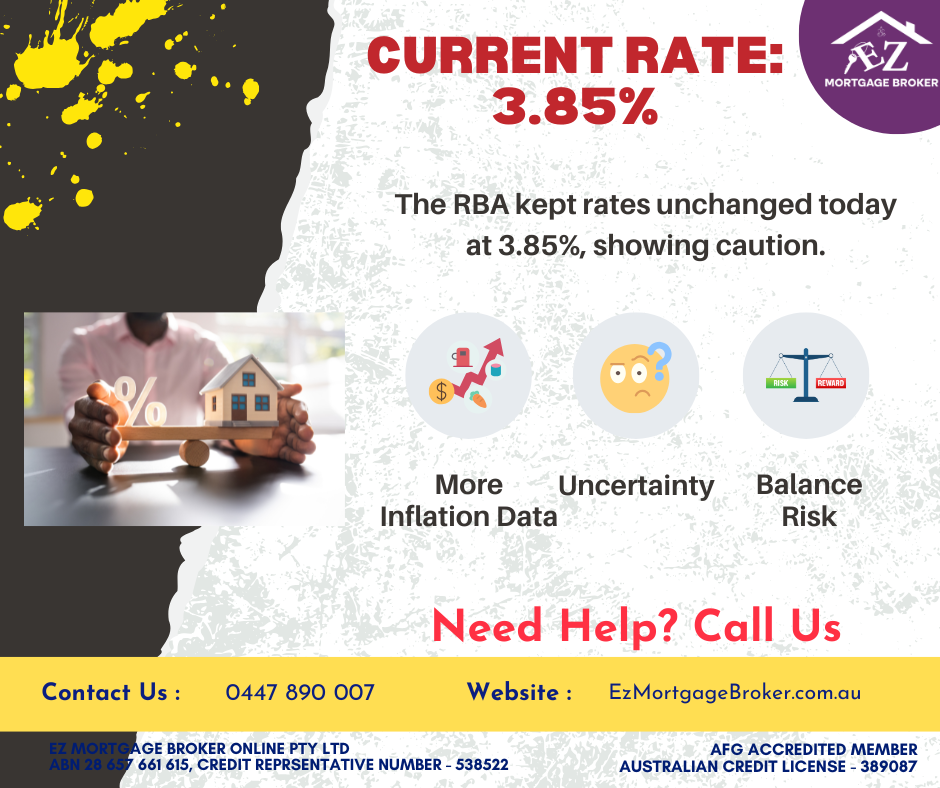

RBA Interest Rate Hold Mortgage: Your Repayment Guide

The RBA’s recent decision to hold the cash rate at 3.85% might leave some Australian mortgage holders feeling the pinch. While rate cuts can take time to fully impact household budgets, many are choosing to maintain higher repayments.

Auction Warning: No Cooling-Off Means Pre-Approved is Must!

Planning to buy at auction? The “no cooling-off” rule is critical. Discover why this means immediate commitment and why auction no cooling off makes pre-approval a must-have.

RBA’s Shock Hold: Why the Rate Cut Didn’t Happen

The RBA surprised markets by holding the cash rate at 3.85% in July 2025. Discover the core RBA reasons for rate hold, including the need for more data and global uncertainties.

RBA Rate Decision Today: What a Cut Could Mean for Your Mortgage

The RBA’s interest rate decision is today. Many predict a cut, bringing good news for homeowners. Learn how potential RBA rate cut savings could affect your budget.