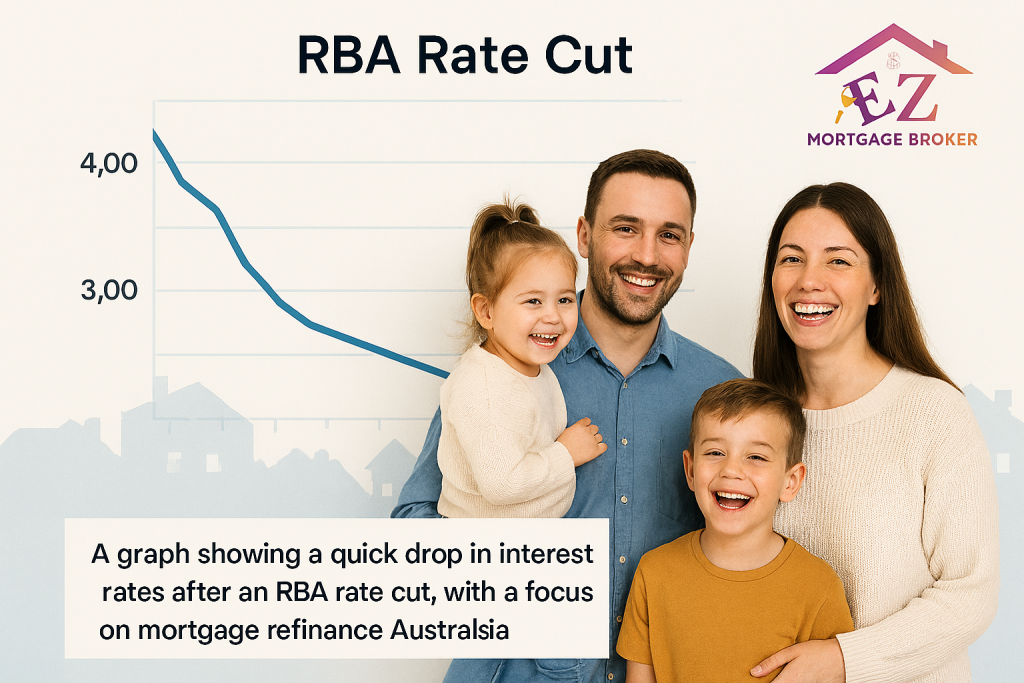

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%. This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions. Which Banks Have Cut Rates? NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act. Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut. More Lenders Are Cutting Costs Many other lenders also cut their rates. This includes: This shows a strong trend. Lenders are moving quickly to pass on lower rates. How Can You Save Money? This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive. Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals. Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

Lenders Cut Home Loan Rates as RBA Move Filters Through

As more lenders cut home loan rates, you could save thousands. Find out which major banks and smaller lenders are passing on the RBA’s cut and how you can get a better deal.

Save Thousands by Switching to a Better Home Loan Rate

Want to save thousands on your mortgage? You can! The latest rates are very low. Experts say you can find deals under 5%. Learn how to get the best deal.

First Home Buyer 5% Deposit Scheme Starts Early! 🏡

Dreaming of owning your first home sooner? The first home buyer 5 deposit scheme is launching early this October! Buy with just a 5% deposit and skip LMI. Learn more!

Australian Mortgage Savings: Rate Cuts Are Here! 💰

Major banks are cutting rates, bringing significant Australian mortgage savings. Learn what this means for your home loan and how a broker can help you get the best deal.

The $100k Gift: How Family Support Widens the Housing Divide

Meet Sarah and Adam, two 24-year-olds with great salaries. But their paths to homeownership are very different. While Adam saves on his own, Sarah has help from the powerful bank of mum and dad—a life-altering $100k gift that will change everything

RBA Rate Cut: These Lenders Slashed Mortgage Rates First

The latest RBA rate cut has brought relief, but not all lenders are acting fast. See which ones were first to pass on the savings and how a mortgage broker can help you find a better deal.

Mortgage Refinance Australia: It’s Time to Switch

A surge in mortgage refinance australia has hit a new high. This shows that homeowners are acting to save thousands of dollars on their loans. A mortgage broker can help you find the best deal for your home loan.