Major banks are cutting rates, bringing significant Australian mortgage savings. Learn what this means for your home loan and how a broker can help you get the best deal.

Big Four Banks Rate Cut: What It Means For You 💰

The big four banks rate cut is finally here, bringing savings to millions. But some lenders are much faster than others. Learn what this rate cut means for your home loan.

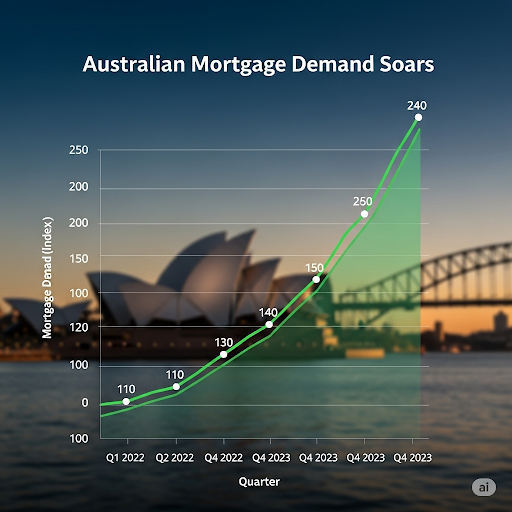

Mortgage Demand Australia is Booming 🚀

Mortgage demand Australia is surging, driven by a big boom in refinancing. Find out what this means for you. We can help you secure a great deal.

Home Buyer Sentiment is the Highest in 4 Years!

Home buyer sentiment has reached its highest point in over four years, thanks to recent rate cuts. This rising confidence is a strong signal for the housing market. Learn how we can help you take advantage of it.

The Real Cost of Lower Mortgage Repayments 💸

New research shows that accepting lower mortgage repayments after a rate cut could cost you thousands. Learn why keeping your repayments the same can save you a fortune and help you pay off your home loan years sooner.

The $100k Gift: How Family Support Widens the Housing Divide

Meet Sarah and Adam, two 24-year-olds with great salaries. But their paths to homeownership are very different. While Adam saves on his own, Sarah has help from the powerful bank of mum and dad—a life-altering $100k gift that will change everything

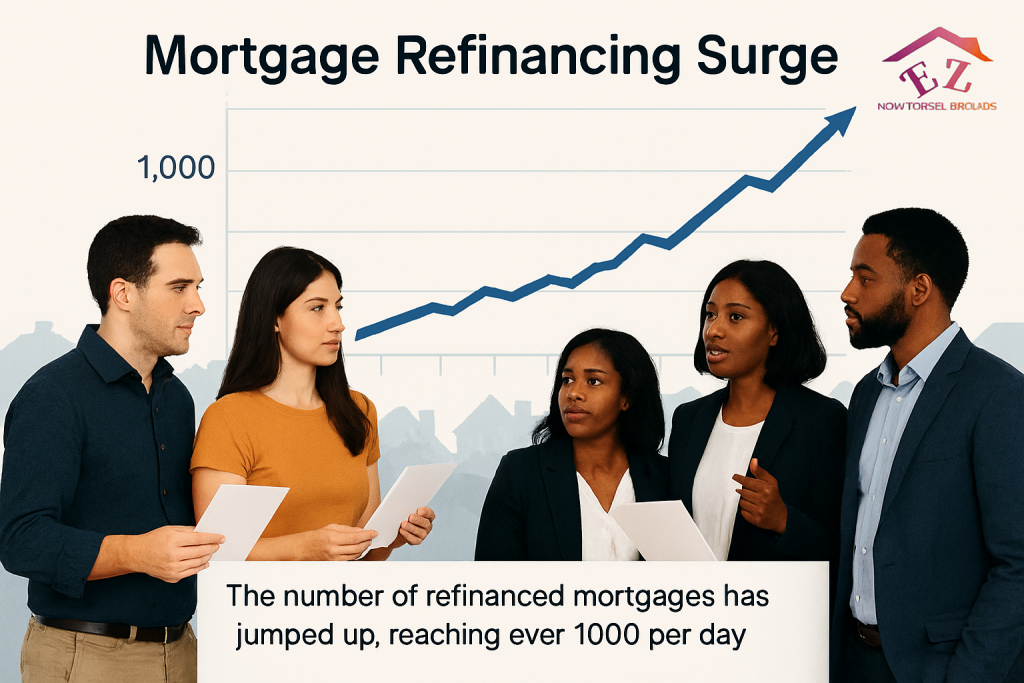

Mortgage Refinance Australia: It’s Time to Switch

A surge in mortgage refinance australia has hit a new high. This shows that homeowners are acting to save thousands of dollars on their loans. A mortgage broker can help you find the best deal for your home loan.

The $41M Cash Buy vs. Your Home Loan

A recent news story about a $41 million home bought with cash highlights the contrast between high-end property deals and the reality for most buyers. For the rest of us, using a expert mortgage broker Australia is key to finding the right home loan.

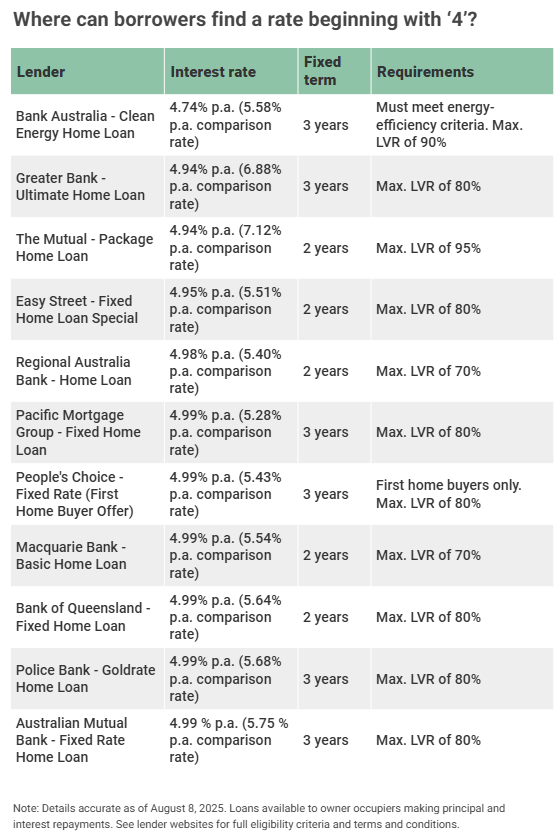

Find a Mortgage Rate Starting with 4

Competition is heating up among lenders, with some now offering a mortgage rate starting with 4. This provides a great opportunity for homeowners to save money by refinancing or for new buyers to lock in a low rate.

Aussie Homeowners Mortgage: What a Study Reveals

A new study reveals that despite significant mortgage payment increases, many Aussie homeowners maintained their spending habits by using savings built up during the pandemic.