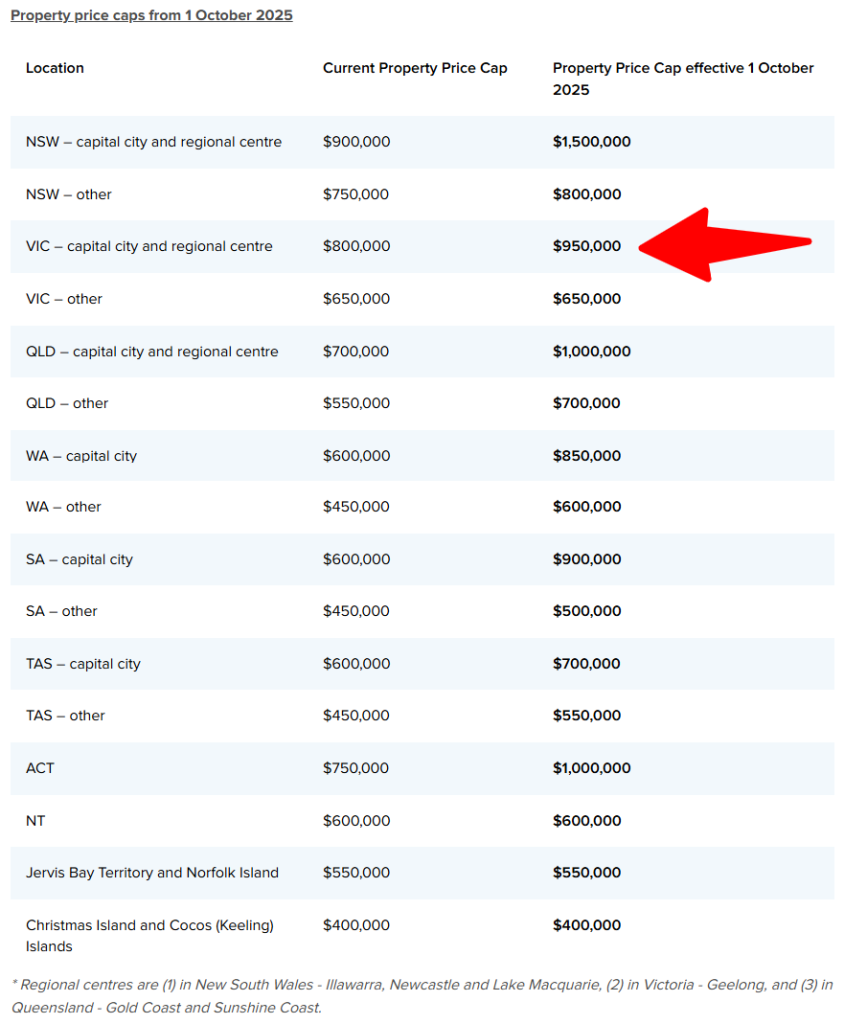

Great news for home buyers! The Home Guarantee Scheme changes are coming soon. They will start on October 1st. This means more people can buy a home. The Big Changes How Can You Apply? The scheme helps you buy a home with a small deposit. You need at least a 5% deposit. The government will help with the rest. This lets you avoid Lenders Mortgage Insurance (LMI). You can apply through a lender. We can help with this. We will check your eligibility. We will guide you through the process. To find out more about the Scheme and view Housing Australia’s Frequently Asked Questions, visit the Housing Australia website here. Also, the Housing Australia Investment Mandate Amendment to effect these changes can be found here. What You Need to Know There are some rules you must follow. You must be an Australian citizen or permanent resident. You must also be 18 years or older. You must also live in the home you buy. You cannot rent it out. This scheme helps you save money and buy a home sooner. The Prime Minister said the goal is to help more people own a home sooner. Contact EZ Mortgage Broker today for a free chat. We can help you start your home buying journey. Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).

First Home Buyer 5% Deposit Scheme Starts Early! 🏡

Dreaming of owning your first home sooner? The first home buyer 5 deposit scheme is launching early this October! Buy with just a 5% deposit and skip LMI. Learn more!

The $41M Cash Buy vs. Your Home Loan

A recent news story about a $41 million home bought with cash highlights the contrast between high-end property deals and the reality for most buyers. For the rest of us, using a expert mortgage broker Australia is key to finding the right home loan.

Easier Home Loans! NAB Joins CBA on HECS/HELP Debt

Great news for Australian homebuyers, especially those with HECS/HELP debt! NAB has announced changes that will make it easier to qualify for a home loan, following in the footsteps of CBA. Find out how this could help you get into your dream home sooner.

Australian Home Prices Record New Highs in June 2025: Your Simple Guide

Australian Home Prices Record new highs in June 2025! Find out what this means for you and how EZ Mortgage Broker can help.