Great news for home buyers! The Home Guarantee Scheme changes are coming soon. They will start on October 1st. This means more people can buy a home. The Big Changes How Can You Apply? The scheme helps you buy a home with a small deposit. You need at least a 5% deposit. The government will help with the rest. This lets you avoid Lenders Mortgage Insurance (LMI). You can apply through a lender. We can help with this. We will check your eligibility. We will guide you through the process. To find out more about the Scheme and view Housing Australia’s Frequently Asked Questions, visit the Housing Australia website here. Also, the Housing Australia Investment Mandate Amendment to effect these changes can be found here. What You Need to Know There are some rules you must follow. You must be an Australian citizen or permanent resident. You must also be 18 years or older. You must also live in the home you buy. You cannot rent it out. This scheme helps you save money and buy a home sooner. The Prime Minister said the goal is to help more people own a home sooner. Contact EZ Mortgage Broker today for a free chat. We can help you start your home buying journey. Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

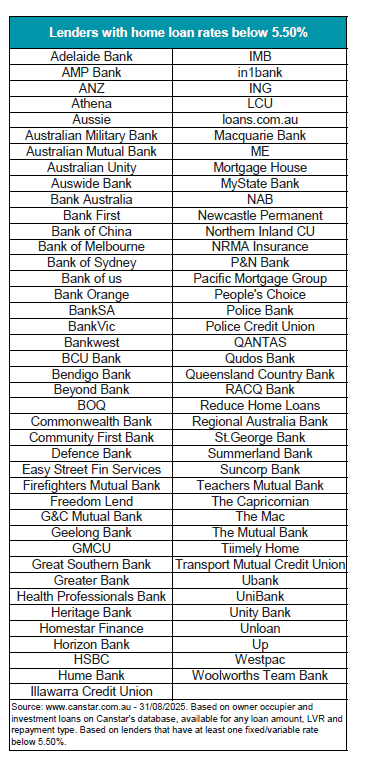

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%. This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions. Which Banks Have Cut Rates? NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act. Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut. More Lenders Are Cutting Costs Many other lenders also cut their rates. This includes: This shows a strong trend. Lenders are moving quickly to pass on lower rates. How Can You Save Money? This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive. Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals. Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%. This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions. Which Banks Have Cut Rates? NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act. Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut. More Lenders Are Cutting Costs Many other lenders also cut their rates. This includes: This shows a strong trend. Lenders are moving quickly to pass on lower rates. How Can You Save Money? This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive. Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals. Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

Your First Home. It Can Be Yours. A 5% Deposit Home Loan Story.

John was convinced it would be impossible for me to buy a home. Then I found this little-known hack: a 5% deposit home loan

Lenders Cut Home Loan Rates as RBA Move Filters Through

As more lenders cut home loan rates, you could save thousands. Find out which major banks and smaller lenders are passing on the RBA’s cut and how you can get a better deal.

Mortgage Rates Tumble for Homeowners 🏡

Great news for homeowners! Mortgage rates tumble as 25 lenders cut costs, with some rates now below 5%. Find out how you can save thousands on your home loan today!

First Home Buyer 5% Deposit Scheme Starts Early! 🏡

Dreaming of owning your first home sooner? The first home buyer 5 deposit scheme is launching early this October! Buy with just a 5% deposit and skip LMI. Learn more!

RBA Interest Rate Hold Mortgage: Your Repayment Guide

The RBA’s recent decision to hold the cash rate at 3.85% might leave some Australian mortgage holders feeling the pinch. While rate cuts can take time to fully impact household budgets, many are choosing to maintain higher repayments.

Auction Warning: No Cooling-Off Means Pre-Approved is Must!

Planning to buy at auction? The “no cooling-off” rule is critical. Discover why this means immediate commitment and why auction no cooling off makes pre-approval a must-have.

Lower Rates Don’t Mean Automatic Lower Mortgage Repayments

When interest rates drop, your mortgage payments might not automatically lower. Banks often require you to take action. Learn more here.