Great news for homeowners! Mortgage rates tumble as 25 lenders cut costs, with some rates now below 5%. Find out how you can save thousands on your home loan today!

Australian Mortgage Savings: Rate Cuts Are Here! 💰

Major banks are cutting rates, bringing significant Australian mortgage savings. Learn what this means for your home loan and how a broker can help you get the best deal.

Big Four Banks Rate Cut: What It Means For You 💰

The big four banks rate cut is finally here, bringing savings to millions. But some lenders are much faster than others. Learn what this rate cut means for your home loan.

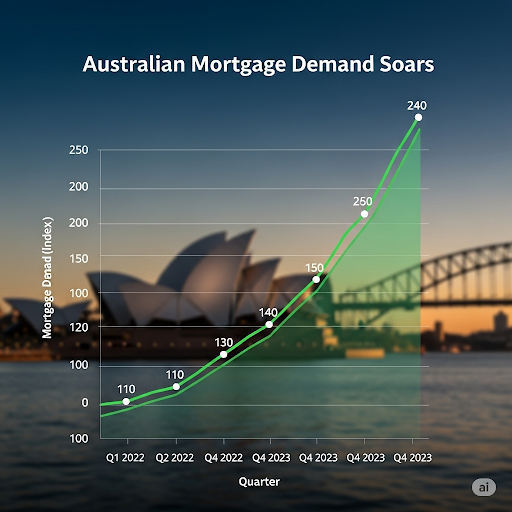

Mortgage Demand Australia is Booming 🚀

Mortgage demand Australia is surging, driven by a big boom in refinancing. Find out what this means for you. We can help you secure a great deal.

Home Buyer Sentiment is the Highest in 4 Years!

Home buyer sentiment has reached its highest point in over four years, thanks to recent rate cuts. This rising confidence is a strong signal for the housing market. Learn how we can help you take advantage of it.

The Real Cost of Lower Mortgage Repayments 💸

New research shows that accepting lower mortgage repayments after a rate cut could cost you thousands. Learn why keeping your repayments the same can save you a fortune and help you pay off your home loan years sooner.

The $100k Gift: How Family Support Widens the Housing Divide

Meet Sarah and Adam, two 24-year-olds with great salaries. But their paths to homeownership are very different. While Adam saves on his own, Sarah has help from the powerful bank of mum and dad—a life-altering $100k gift that will change everything

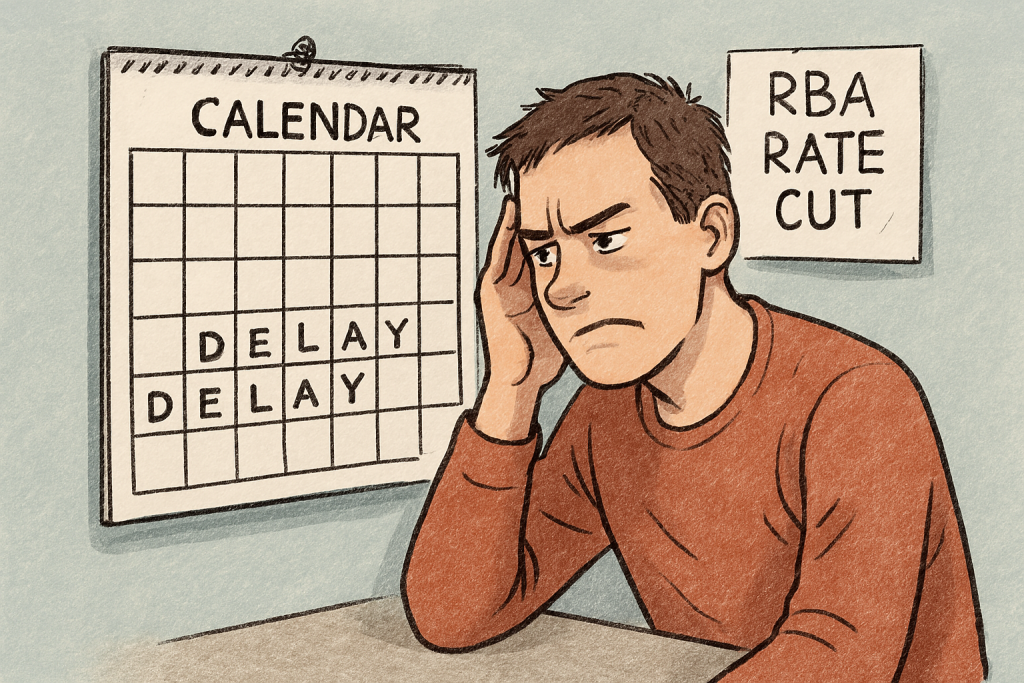

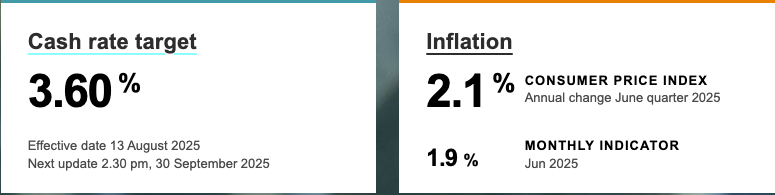

RBA Rate Cut Delays: Why Your Mortgage Relief May Be Late

The RBA has cut rates, but many banks are delaying the savings. With some borrowers waiting weeks for relief, this highlights why a good mortgage broker australia is essential to find a lender that passes on rate cuts faster. Don’t let RBA rate cut delays cost you money.

RBA Rate Cut: How Banks Are Responding

The RBA has cut its cash rate, and major banks like Commonwealth, ANZ, and Macquarie are responding. While this could mean savings for many, it’s also the perfect time to review your home loan to ensure you’re getting the best possible deal. Find out what this RBA rate cut response means for your mortgage.

Aussie Homeowners Mortgage: What a Study Reveals

A new study reveals that despite significant mortgage payment increases, many Aussie homeowners maintained their spending habits by using savings built up during the pandemic.