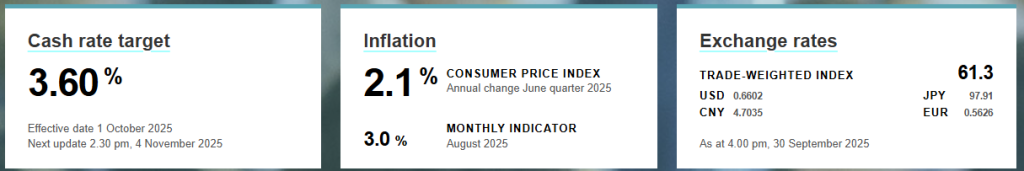

The RBA has kept the official cash rate at 3.60%, delaying relief for mortgage holders. Governor Bullock cited slowing inflation progress and sticky prices as reasons for the “hawkish hold.”

First Home Buyer Rates: New Deals Below 5% 🏡

New first home buyer rates are hitting 4.99% as competition heats up. Learn how to get the best deal, what it means for refinancers, and how a broker can help you.

We Are Growing Fast. What This Means for You

Mortgage brokers have a record market share, and the fastest growing mortgage brokerages are succeeding by focusing on clients. We explain what this means for you.

Mortgage Stress: When to Walk Away 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path.

Mortgage Stress: When to Walk Away 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

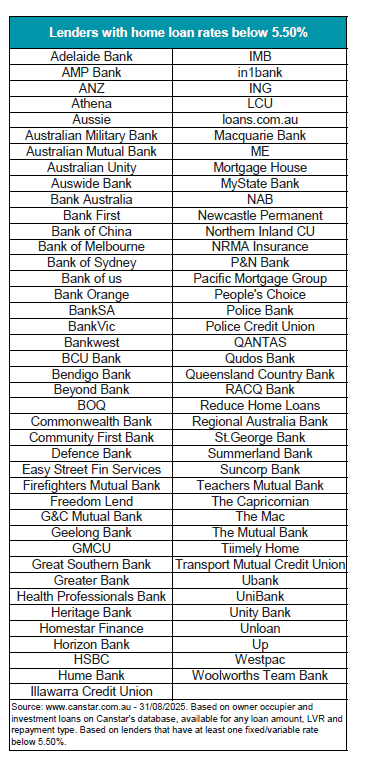

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%. This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions. Which Banks Have Cut Rates? NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act. Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut. More Lenders Are Cutting Costs Many other lenders also cut their rates. This includes: This shows a strong trend. Lenders are moving quickly to pass on lower rates. How Can You Save Money? This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive. Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals. Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%. This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions. Which Banks Have Cut Rates? NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act. Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut. More Lenders Are Cutting Costs Many other lenders also cut their rates. This includes: This shows a strong trend. Lenders are moving quickly to pass on lower rates. How Can You Save Money? This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive. Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals. Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

Your First Home. It Can Be Yours. A 5% Deposit Home Loan Story.

John was convinced it would be impossible for me to buy a home. Then I found this little-known hack: a 5% deposit home loan

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

Mortgage demand Australia is surging, driven by a boom in refinancing. Find out what this means for you and how to secure a great deal.

Lenders Cut Home Loan Rates as RBA Move Filters Through

As more lenders cut home loan rates, you could save thousands. Find out which major banks and smaller lenders are passing on the RBA’s cut and how you can get a better deal.