As more lenders cut home loan rates, you could save thousands. Find out which major banks and smaller lenders are passing on the RBA’s cut and how you can get a better deal.

RBA Rate Cut: These Lenders Slashed Mortgage Rates First

The latest RBA rate cut has brought relief, but not all lenders are acting fast. See which ones were first to pass on the savings and how a mortgage broker can help you find a better deal.

RBA Rate Cut Delays: Why Your Mortgage Relief May Be Late

The RBA has cut rates, but many banks are delaying the savings. With some borrowers waiting weeks for relief, this highlights why a good mortgage broker australia is essential to find a lender that passes on rate cuts faster. Don’t let RBA rate cut delays cost you money.

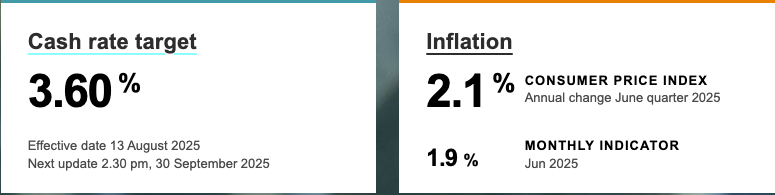

RBA Rate Cut: How Banks Are Responding

The RBA has cut its cash rate, and major banks like Commonwealth, ANZ, and Macquarie are responding. While this could mean savings for many, it’s also the perfect time to review your home loan to ensure you’re getting the best possible deal. Find out what this RBA rate cut response means for your mortgage.

ANZ vs BoQ: The Mortgage Market Is a “Rollercoaster”

The mortgage market is a ‘rollercoaster’ of changes. While ANZ hiked some rates, Bank of Queensland dropped a new low fixed rate. This market shows why a mortgage broker australia is key to finding the best deal for your home loan

Mortgage Rates are Coming Down: Is It Too Late for the Australian Economy?

As of August 2025, mortgage rates are starting to fall. But did the RBA wait too long? Learn what this means for your home loan.