John was convinced it would be impossible for me to buy a home. Then I found this little-known hack: a 5% deposit home loan

RBA Interest Rate Hold Mortgage: Your Repayment Guide

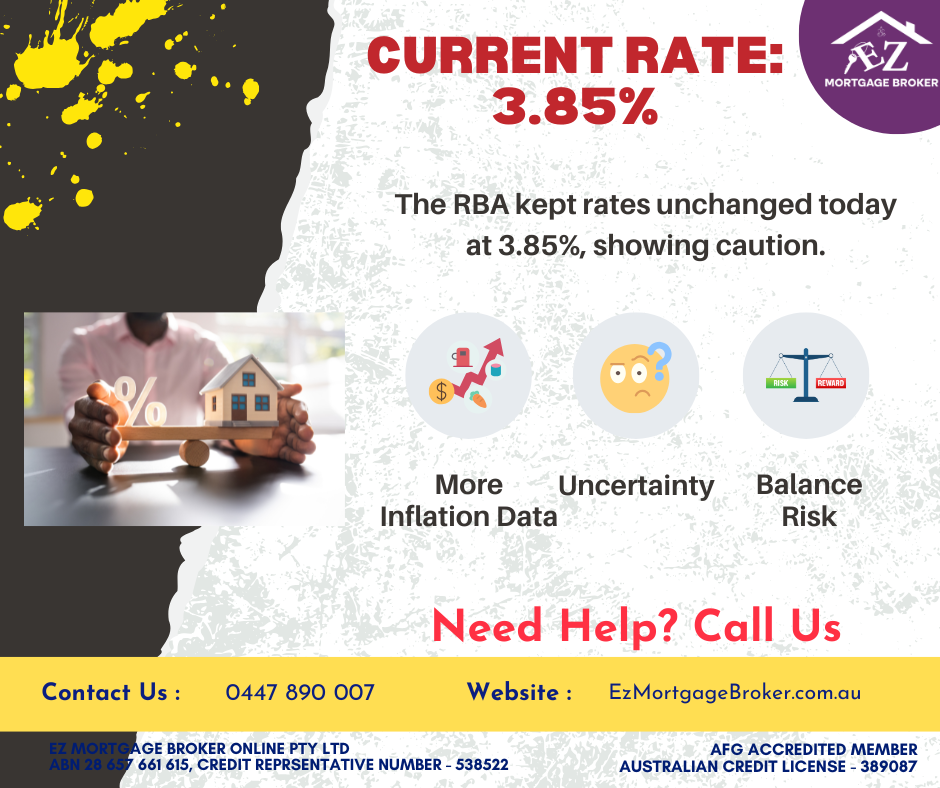

The RBA’s recent decision to hold the cash rate at 3.85% might leave some Australian mortgage holders feeling the pinch. While rate cuts can take time to fully impact household budgets, many are choosing to maintain higher repayments.

Westpac Self-Employed Loans: Easier Home Buying Now!

Great news for self-employed Australians! Westpac has changed its home loan rules. Getting Westpac self-employed loans is now much simpler. Read on to find out how this helps you.

Mortgage Game-Changer: RBA Rate Cut on the Horizon & Fixed Rates Below 5%!

Big news for Australian homeowners! ANZ has slashed fixed rates, hinting at an RBA cut. Even better, a growing number of lenders are now offering fixed rates below 5%!