Meet Sarah and Adam, two 24-year-olds with great salaries. But their paths to homeownership are very different. While Adam saves on his own, Sarah has help from the powerful bank of mum and dad—a life-altering $100k gift that will change everything

Find a Mortgage Rate Starting with 4

Competition is heating up among lenders, with some now offering a mortgage rate starting with 4. This provides a great opportunity for homeowners to save money by refinancing or for new buyers to lock in a low rate.

Aussie Homeowners Mortgage: What a Study Reveals

A new study reveals that despite significant mortgage payment increases, many Aussie homeowners maintained their spending habits by using savings built up during the pandemic.

Australian Residential Mortgages Surge: What This Means for You

New figures show a big change in the market. Australian residential mortgages hit a new high. At the same time, many people are using their savings. This is a big shift. Household deposits fell by $12 billion in June. This is the first drop in a year. While some of this is normal end-of-financial-year spending, it shows a trend. The market saw a huge rise in residential mortgages. Loans went up by $17.7 billion in June. This was the biggest jump since June 2021. It was driven by two recent RBA rate cuts. What is Happening with Australian Residential Mortgages? The market is reacting to falling inflation. This has led to hope for more interest rate cuts. Experts think the RBA may cut rates again in August. This could bring even more life to the property market. This surge in Australian residential mortgages shows that many people are buying homes. It also shows that many are refinancing their loans. The biggest banks still have a lot of the market. But they do not always have the best rates. A mortgage broker can give you more choices. How Can a Mortgage Broker Help? A mortgage broker works for you. Not the bank. They look at your finances. They help you find a loan that is right for you. They can also help you understand all the options. For example, a broker can help you: This can help you keep your savings safe. You can get more information on our Home Loan Documents Checklist page. You can also find more data from Canstar on these trends. <img src=”path/to/11112.png” alt=”A close-up of a smartphone screen showing a graph of total funds. This reflects the financial trends of Australian residential mortgages and household savings.” /> Ready to Find a Smarter Way to Manage Your Mortgage? Do you want to know more about the market? Are you looking for a new loan? A simple chat with a broker can help. Contact EZ MORTGAGE BROKER (Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087) today for a free, no-obligation chat.

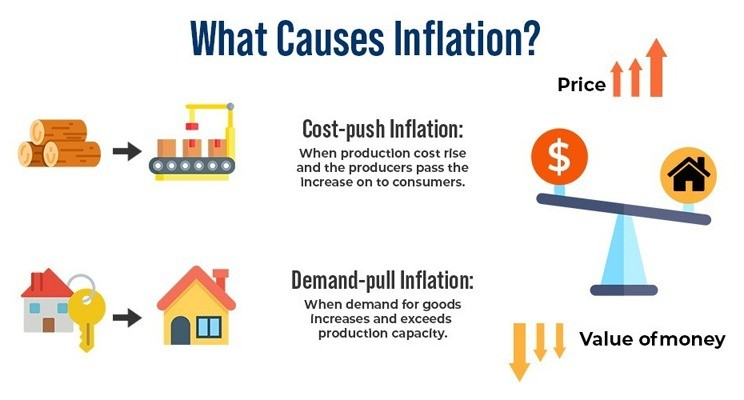

Mortgage Costs in Melbourne Are Up: How to Protect Your Savings

New data from Canstar shows that Australians have been forced to dip into their savings. This is because mortgage costs in Melbourne and across the country have ballooned. The amount of money lent to borrowers for mortgages went up by a record $17.7 billion in June. This was fueled by the two interest rate cuts in February and May. “The residential mortgage market went into overdrive in June, fueled by the two cash rate cuts in February and May,” said Sally Tindall from Canstar. The big jump in mortgages mirrors the continued rise in property prices. As a result, household savings fell by 0.74 per cent in June. This is the first drop in a year. It’s the biggest fall in over two years. Is This Drop a Big Problem? Sally Tindall says this drop in savings is common this time of year. Many people spend more on end-of-financial-year costs. “Household savings took a hit in June as people tucked into their savings to pay for end-of-financial-year costs,” she said. “However, we expect this dip to be temporary, despite the cost-of-living crunch. Australians remain steadfast in building up their war chests.” Despite this, it’s a good reminder to keep a close eye on your finances. Good News on the Horizon with Inflation Data There is some good news for homeowners. The Australian Bureau of Statistics released data showing that inflation has reached its lowest level since the pandemic. The latest figures for the trimmed mean inflation are 0.6% for the quarter and 2.7% for the year. This brings inflation squarely within the Reserve Bank of Australia’s (RBA) target range of 2% to 3%. This makes another rate cut very likely. The RBA is set to meet on August 12. Many experts are sure they will cut rates again. This could bring welcome relief to your household budget. This potential rate cut is especially important for those with mortgages. It could help ease the pressure on your savings account. Why Your Savings Are Stretched Even as some prices fall, others are still rising fast. Recent data shows some goods are more expensive, while others are cheaper: Prices are up for: Prices are down for: The mixed bag of price changes means that while some costs are falling, essential items like food are still straining household budgets. This highlights why managing your mortgage costs in Melbourne is more important than ever. How EZ MORTGAGE BROKER Can Help You The ups and downs of the mortgage market can be tough to navigate. You want to make sure you are in the best possible position. You want to keep your mortgage costs low. You also want to protect your hard-earned savings. At EZ MORTGAGE BROKER, we understand these challenges. We are here to help homeowners in Melbourne, Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, and Werribee. Our goal is to make sure you have the right loan for your needs. We can help you: Don’t wait until your savings are in trouble. Take control of your mortgage costs now. Contact EZ MORTGAGE BROKER today for a free, no-obligation chat. We can help you find a smarter way to manage your mortgage. Phone: 1300 050 099 Email: [email protected]

Mortgage Rates are Coming Down: Is It Too Late for the Australian Economy?

As of August 2025, mortgage rates are starting to fall. But did the RBA wait too long? Learn what this means for your home loan.

RBA Rate Cut Hopes for Tarneit Homeowners Hang on Inflation Data

Homeowners are eager for RBA rate cuts. But the central bank is waiting for key inflation data. EZ MORTGAGE BROKER explains what this means for your loan in Tarneit and Melbourne.

Mortgage Stress Tarneit: Get Help Now

Mortgage stress is growing in Australia. It affects homes in Tarneit, Wyndham, and Melbourne. Find out why. EZ MORTGAGE BROKER offers support.

RBA Interest Rate Hold Mortgage: Your Repayment Guide

The RBA’s recent decision to hold the cash rate at 3.85% might leave some Australian mortgage holders feeling the pinch. While rate cuts can take time to fully impact household budgets, many are choosing to maintain higher repayments.

RBA’s Shock Hold: Why the Rate Cut Didn’t Happen

The RBA surprised markets by holding the cash rate at 3.85% in July 2025. Discover the core RBA reasons for rate hold, including the need for more data and global uncertainties.