A surge in mortgage refinance australia has hit a new high. This shows that homeowners are acting to save thousands of dollars on their loans. A mortgage broker can help you find the best deal for your home loan.

Mortgage Costs in Melbourne Are Up: How to Protect Your Savings

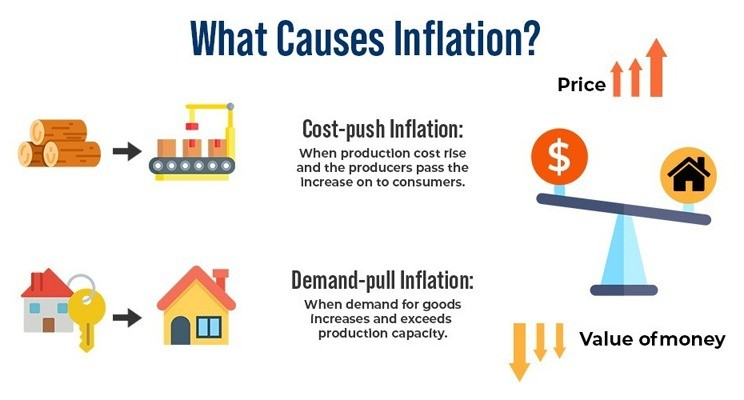

New data from Canstar shows that Australians have been forced to dip into their savings. This is because mortgage costs in Melbourne and across the country have ballooned. The amount of money lent to borrowers for mortgages went up by a record $17.7 billion in June. This was fueled by the two interest rate cuts in February and May. “The residential mortgage market went into overdrive in June, fueled by the two cash rate cuts in February and May,” said Sally Tindall from Canstar. The big jump in mortgages mirrors the continued rise in property prices. As a result, household savings fell by 0.74 per cent in June. This is the first drop in a year. It’s the biggest fall in over two years. Is This Drop a Big Problem? Sally Tindall says this drop in savings is common this time of year. Many people spend more on end-of-financial-year costs. “Household savings took a hit in June as people tucked into their savings to pay for end-of-financial-year costs,” she said. “However, we expect this dip to be temporary, despite the cost-of-living crunch. Australians remain steadfast in building up their war chests.” Despite this, it’s a good reminder to keep a close eye on your finances. Good News on the Horizon with Inflation Data There is some good news for homeowners. The Australian Bureau of Statistics released data showing that inflation has reached its lowest level since the pandemic. The latest figures for the trimmed mean inflation are 0.6% for the quarter and 2.7% for the year. This brings inflation squarely within the Reserve Bank of Australia’s (RBA) target range of 2% to 3%. This makes another rate cut very likely. The RBA is set to meet on August 12. Many experts are sure they will cut rates again. This could bring welcome relief to your household budget. This potential rate cut is especially important for those with mortgages. It could help ease the pressure on your savings account. Why Your Savings Are Stretched Even as some prices fall, others are still rising fast. Recent data shows some goods are more expensive, while others are cheaper: Prices are up for: Prices are down for: The mixed bag of price changes means that while some costs are falling, essential items like food are still straining household budgets. This highlights why managing your mortgage costs in Melbourne is more important than ever. How EZ MORTGAGE BROKER Can Help You The ups and downs of the mortgage market can be tough to navigate. You want to make sure you are in the best possible position. You want to keep your mortgage costs low. You also want to protect your hard-earned savings. At EZ MORTGAGE BROKER, we understand these challenges. We are here to help homeowners in Melbourne, Tarneit, Wyndham, Hoppers Crossing, Point Cook, Melton, Rockbank, and Werribee. Our goal is to make sure you have the right loan for your needs. We can help you: Don’t wait until your savings are in trouble. Take control of your mortgage costs now. Contact EZ MORTGAGE BROKER today for a free, no-obligation chat. We can help you find a smarter way to manage your mortgage. Phone: 1300 050 099 Email: [email protected]

New Home Loans Up, Refinancing Soars in FY25: What It Means for You in Melbourne

New loan activity and refinancing saw big jumps in FY25. Discover what this PEXA report reveals for your home loan in Melbourne and surrounding areas.

RBA Rate Cut Hopes for Tarneit Homeowners Hang on Inflation Data

Homeowners are eager for RBA rate cuts. But the central bank is waiting for key inflation data. EZ MORTGAGE BROKER explains what this means for your loan in Tarneit and Melbourne.

Your Guide to the Melbourne Property Market: 7 Simple Facts

Unpack the Australian property market with 7 easy-to-understand facts. Learn how trends impact Melbourne, Tarneit, and Western suburbs.

Mortgage Stress Tarneit: Get Help Now

Mortgage stress is growing in Australia. It affects homes in Tarneit, Wyndham, and Melbourne. Find out why. EZ MORTGAGE BROKER offers support.

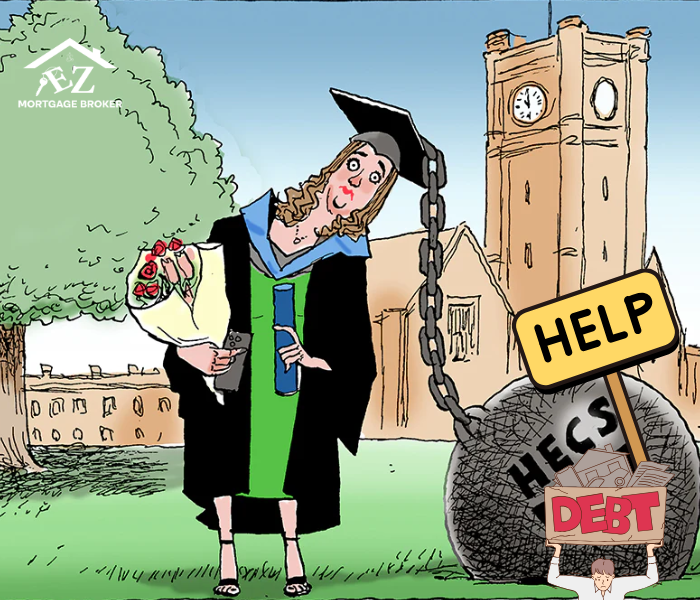

Easier Home Loans! NAB Joins CBA on HECS/HELP Debt

Great news for Australian homebuyers, especially those with HECS/HELP debt! NAB has announced changes that will make it easier to qualify for a home loan, following in the footsteps of CBA. Find out how this could help you get into your dream home sooner.