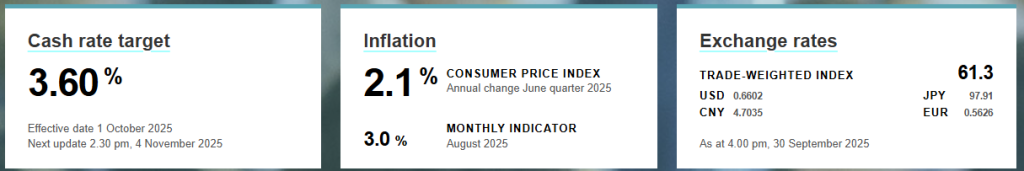

The RBA has kept the official cash rate at 3.60%, delaying relief for mortgage holders. Governor Bullock cited slowing inflation progress and sticky prices as reasons for the “hawkish hold.”

We Are Growing Fast. What This Means for You

Mortgage brokers have a record market share, and the fastest growing mortgage brokerages are succeeding by focusing on clients. We explain what this means for you.

Mortgage Stress: When to Walk Away 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path.

Mortgage Stress: When to Walk Away 😔

Are you facing mortgage stress? Read Tash and Matt’s story about selling their Sydney home to find financial freedom. Learn when it might be time to consider a new path

Sydney Melbourne Property Prices: A New Forecast

Prices for homes in Sydney and Melbourne are going up fast. Buyer confidence is growing. This is making the market rebound quickly. Westpac has a new forecast. It says that Sydney and Melbourne property prices could jump a lot by the end of 2026. What Could Happen to Prices? Westpac expects Sydney prices to rise 5% this year and 8% in 2026. This could add over $150,000 to the median price. The median price could reach $1,675,827 by December 2026. Melbourne is also set for big gains. Westpac forecasts prices will rise 4% this year and 10% in 2026. This could push the median price past $1 million by the end of 2026. Other cities are also seeing strong growth. Perth is expected to rise 8% this year. ANZ also tips Brisbane to grow by 7.4% by the end of 2025. The News is Mixed These rising prices are good for people who already own a home. Their home is now worth more. But for new buyers, this can be hard. The money you need for a deposit gets bigger. It also gets harder to get a loan from a bank. The extra money you can borrow at lower rates might be lost. This is because the prices of homes are rising so fast. What This Means For You The market is strong. But it comes with risks. A forecast is not a guarantee. Prices can change if the RBA changes rates or if the economy shifts. It is important not to borrow too much. It could be risky if things change. A good plan and a good loan are key. You can read our article on how to avoid paying too much for a home. <img src=”https://storage.googleapis.com/gcp-bucket-5392500/property_price_forecast_graph.png” alt=”A graph showing a rising trend in Sydney and Melbourne property prices.”> We can help you find a loan that fits your real financial situation. We can help you navigate this fast-moving market. Contact EZ Mortgage Broker today for a free chat. Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

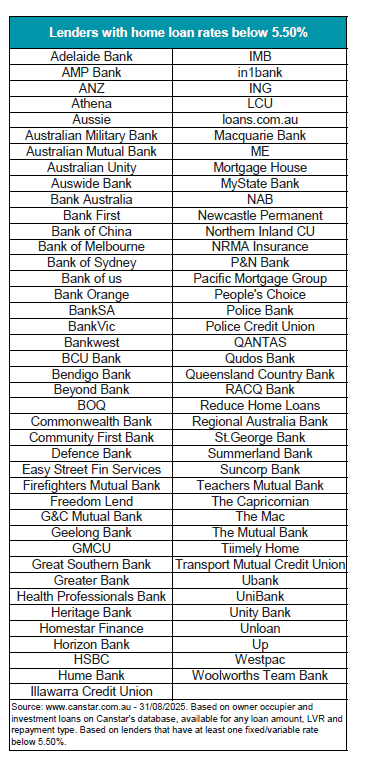

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%. This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions. Which Banks Have Cut Rates? NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act. Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut. More Lenders Are Cutting Costs Many other lenders also cut their rates. This includes: This shows a strong trend. Lenders are moving quickly to pass on lower rates. How Can You Save Money? This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive. Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals. Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

There is great news for Australian homeowners. Lenders cut mortgage rates across the country. This is happening two weeks after the RBA’s August cut. NAB, Westpac, and Bendigo Bank have all lowered their rates. This is good news for you. Some of these cuts are as much as 0.41%. This shows that competition is strong among lenders. More banks are jumping on board. This wave of cuts is a direct response to the RBA’s recent decisions. Which Banks Have Cut Rates? NAB has cut rates by 0.25% on many loans. Their new low rate is now 5.69%. Westpac also cut rates by 0.25%. Their most competitive new rate is 5.34% for a popular refinancing loan. Westpac was the last of the big four to act. Bendigo Bank made some of the biggest cuts. They lowered home loan rates by up to 0.41%. This is more than the RBA’s cut. More Lenders Are Cutting Costs Many other lenders also cut their rates. This includes: This shows a strong trend. Lenders are moving quickly to pass on lower rates. How Can You Save Money? This is a great time to check your home loan. You may be able to get a much better rate. A lower rate can save you money. It can also help you pay off your loan faster. The market is very competitive. Our team can help you. We can look at your current loan. We can find a great rate for your needs. We are experts in finding the best deals. Contact EZ Mortgage Broker today for a free chat. We will help you navigate these changes.

Your First Home. It Can Be Yours. A 5% Deposit Home Loan Story.

John was convinced it would be impossible for me to buy a home. Then I found this little-known hack: a 5% deposit home loan

Lenders Cut Mortgage Rates: More Relief for Borrowers 💰

Mortgage demand Australia is surging, driven by a boom in refinancing. Find out what this means for you and how to secure a great deal.

Lenders Cut Home Loan Rates as RBA Move Filters Through

As more lenders cut home loan rates, you could save thousands. Find out which major banks and smaller lenders are passing on the RBA’s cut and how you can get a better deal.