Dreaming of owning your first home sooner? The first home buyer 5 deposit scheme is launching early this October! Buy with just a 5% deposit and skip LMI. Learn more!

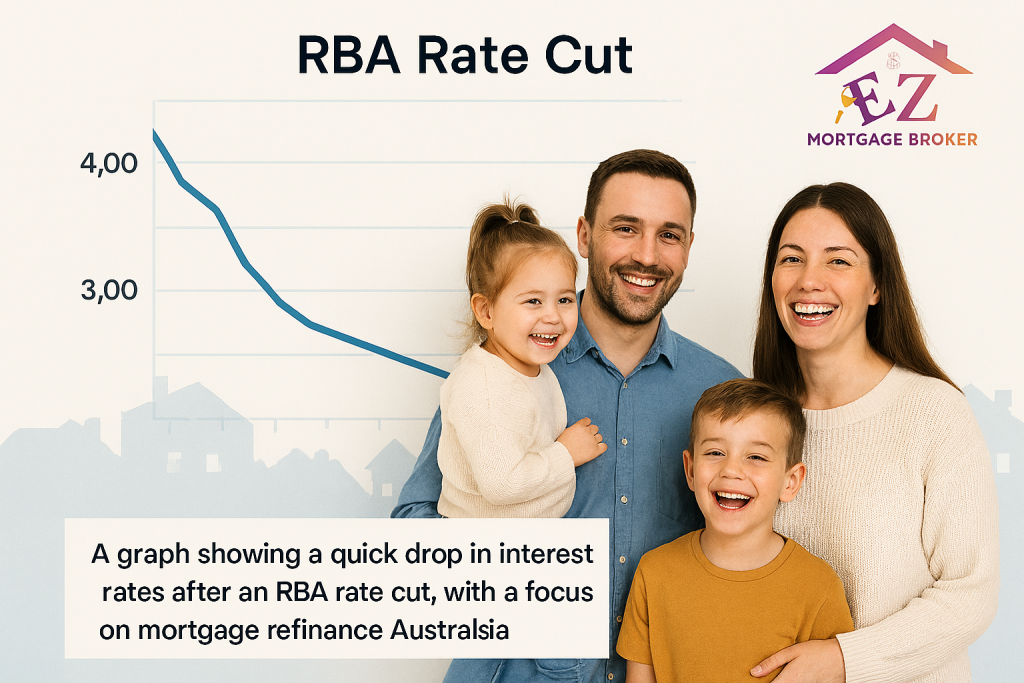

RBA Rate Cut: These Lenders Slashed Mortgage Rates First

The latest RBA rate cut has brought relief, but not all lenders are acting fast. See which ones were first to pass on the savings and how a mortgage broker can help you find a better deal.

Mortgage Refinance Australia: It’s Time to Switch

A surge in mortgage refinance australia has hit a new high. This shows that homeowners are acting to save thousands of dollars on their loans. A mortgage broker can help you find the best deal for your home loan.

Australian Residential Mortgages Surge: What This Means for You

New figures show a big change in the market. Australian residential mortgages hit a new high. At the same time, many people are using their savings. This is a big shift. Household deposits fell by $12 billion in June. This is the first drop in a year. While some of this is normal end-of-financial-year spending, it shows a trend. The market saw a huge rise in residential mortgages. Loans went up by $17.7 billion in June. This was the biggest jump since June 2021. It was driven by two recent RBA rate cuts. What is Happening with Australian Residential Mortgages? The market is reacting to falling inflation. This has led to hope for more interest rate cuts. Experts think the RBA may cut rates again in August. This could bring even more life to the property market. This surge in Australian residential mortgages shows that many people are buying homes. It also shows that many are refinancing their loans. The biggest banks still have a lot of the market. But they do not always have the best rates. A mortgage broker can give you more choices. How Can a Mortgage Broker Help? A mortgage broker works for you. Not the bank. They look at your finances. They help you find a loan that is right for you. They can also help you understand all the options. For example, a broker can help you: This can help you keep your savings safe. You can get more information on our Home Loan Documents Checklist page. You can also find more data from Canstar on these trends. <img src=”path/to/11112.png” alt=”A close-up of a smartphone screen showing a graph of total funds. This reflects the financial trends of Australian residential mortgages and household savings.” /> Ready to Find a Smarter Way to Manage Your Mortgage? Do you want to know more about the market? Are you looking for a new loan? A simple chat with a broker can help. Contact EZ MORTGAGE BROKER (Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087) today for a free, no-obligation chat.

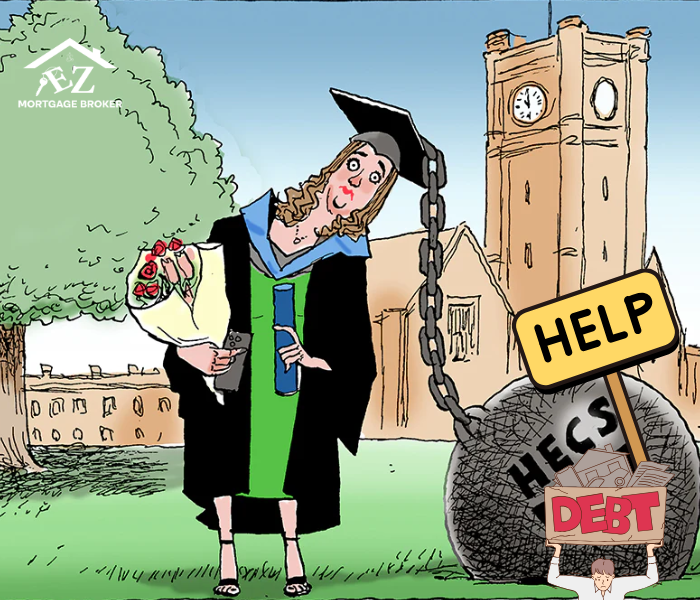

Easier Home Loans! NAB Joins CBA on HECS/HELP Debt

Great news for Australian homebuyers, especially those with HECS/HELP debt! NAB has announced changes that will make it easier to qualify for a home loan, following in the footsteps of CBA. Find out how this could help you get into your dream home sooner.