Prices for homes in Sydney and Melbourne are going up fast. Buyer confidence is growing. This is making the market rebound quickly. Westpac has a new forecast. It says that Sydney and Melbourne property prices could jump a lot by the end of 2026. What Could Happen to Prices? Westpac expects Sydney prices to rise 5% this year and 8% in 2026. This could add over $150,000 to the median price. The median price could reach $1,675,827 by December 2026. Melbourne is also set for big gains. Westpac forecasts prices will rise 4% this year and 10% in 2026. This could push the median price past $1 million by the end of 2026. Other cities are also seeing strong growth. Perth is expected to rise 8% this year. ANZ also tips Brisbane to grow by 7.4% by the end of 2025. The News is Mixed These rising prices are good for people who already own a home. Their home is now worth more. But for new buyers, this can be hard. The money you need for a deposit gets bigger. It also gets harder to get a loan from a bank. The extra money you can borrow at lower rates might be lost. This is because the prices of homes are rising so fast. What This Means For You The market is strong. But it comes with risks. A forecast is not a guarantee. Prices can change if the RBA changes rates or if the economy shifts. It is important not to borrow too much. It could be risky if things change. A good plan and a good loan are key. You can read our article on how to avoid paying too much for a home. <img src=”https://storage.googleapis.com/gcp-bucket-5392500/property_price_forecast_graph.png” alt=”A graph showing a rising trend in Sydney and Melbourne property prices.”> We can help you find a loan that fits your real financial situation. We can help you navigate this fast-moving market. Contact EZ Mortgage Broker today for a free chat. Important Information: Mortgage Broker Online Pty Ltd, ABN: 28 657 661 615, Credit Rep Number 538522. AFG Accredited Member (AFG Australian Credit Licence: 389087).

Big Four Banks Rate Cut: What It Means For You 💰

The big four banks rate cut is finally here, bringing savings to millions. But some lenders are much faster than others. Learn what this rate cut means for your home loan.

RBA Rate Cut Delays: Why Your Mortgage Relief May Be Late

The RBA has cut rates, but many banks are delaying the savings. With some borrowers waiting weeks for relief, this highlights why a good mortgage broker australia is essential to find a lender that passes on rate cuts faster. Don’t let RBA rate cut delays cost you money.

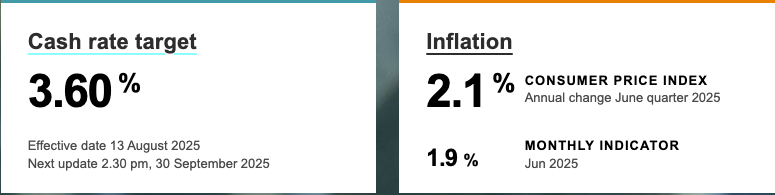

RBA Rate Cut: How Banks Are Responding

The RBA has cut its cash rate, and major banks like Commonwealth, ANZ, and Macquarie are responding. While this could mean savings for many, it’s also the perfect time to review your home loan to ensure you’re getting the best possible deal. Find out what this RBA rate cut response means for your mortgage.

Westpac Self-Employed Loans: Easier Home Buying Now!

Great news for self-employed Australians! Westpac has changed its home loan rules. Getting Westpac self-employed loans is now much simpler. Read on to find out how this helps you.